|

There is something about working in the Brexit department which doesn't bode well. Joyce Anelay, Minister in the House of Lords resigned from the project this week. Cold feet? Perhaps, Joyce hurt her foot jumping out of a helicopter two years ago, the pain lingers on.

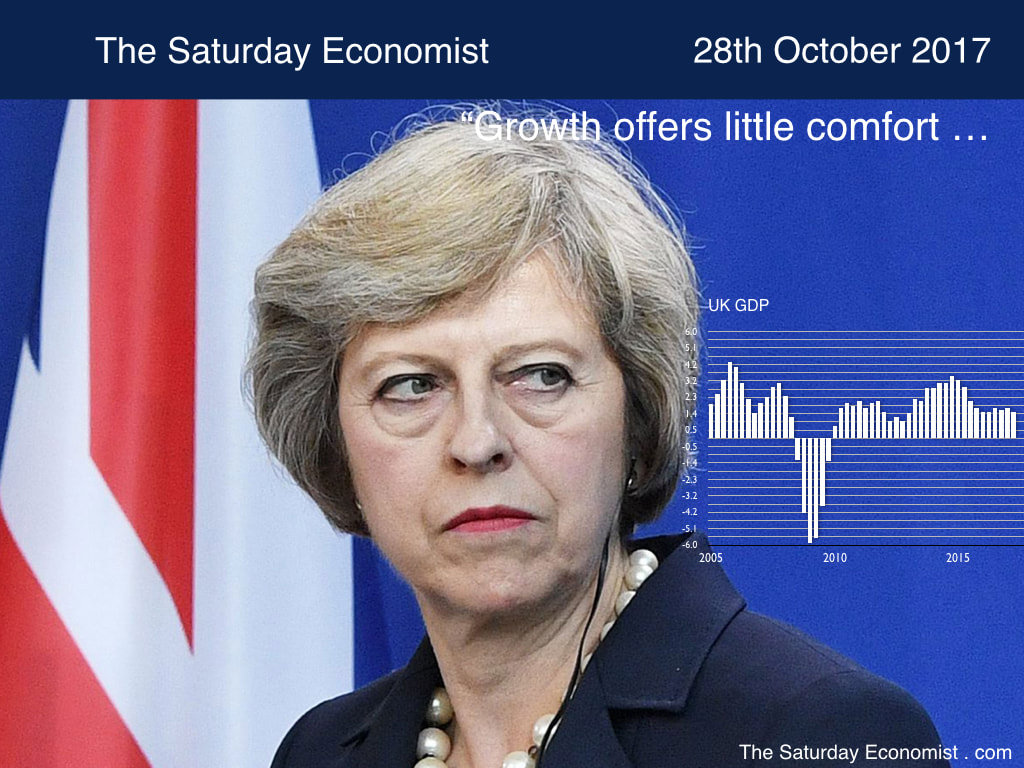

Or perhaps one leap into the unknown is enough, for Baroness Anelay. The EU department casualty list now includes George Bridges, David Jones and Olly Robbins permanent secretary. David Davis' skills as a negotiator do not extend to talks with his own team apparently. Davis has a reputation for being something of a lone wolf in the execution of duties. Baroness Anelay remains confident about the future "I leave the department certain the negotiations surrounding our exit and our future relationship with the EU will be successful", she said. Well that's good to know. "We have a very strong team of ministers and officials in the department". The Prime Minister replied. Mmmm ... meanwhile ... The negotiations may go down to the wire, Davis explained this week. So much so, the parliamentary vote to leave the EU, may take place once we have left. Shocking! Davis was swiftly denounced at PMQs. Parliament will have the final say on the negotiations once completed, the PM affirmed. The Tory back benches were not convinced. According to the Evening Standard, senior Conservative MPs plan to go over the Prime Minister's head and seek their own talks with the European Union. They want to be sure May is offering the best terms available! The best terms available do not include a refund from the European Investment Bank apparently. The UK may have to wait until 2054 to reap the dividend and return of any investment cash. Alexander Stubb Vice President of the EIB explained this week, we may even have to cough up more, if any investments back fire. The impossible task of reconciling the ambitions of a divided Tory party continue ... Economics news this week ... The preliminary estimate of growth in the third quarter was released this week. Growth of 1.5% in the quarter will offer little comfort to the beleagured Prime Minister. The growth rate was unchanged from the second quarter and down on the first quarter of the year (1.8%). Good news in manufacturing and construction. Manufacturing growth was up by 2.7% and construction growth increased by 2.8%. Service sector growth slowed to 1.5%, with a pronounced weakness in transport and business services. Based on the latest data, we now expect growth of around 1.6% this year, compared to 1.8% in 2016. Will this be enough to push rates higher next month? It will be a close call, the Governor may decide to wait and see once again. The latest data from the SMMT on car production are of concern. Output fell by 4% in September and by 2.2% in the year to date. Manufacturing output for the home market was down by 14% in the month. Worries about toxic fumes from Brexit and diesel, are fueling concerns for domestic buyers and producers. Over in the U.S.A. the latest figures led to headline talk of 3% growth in the third quarter. It is misleading. The quarterly growth rate annualised is the process. The year on year comparison is the more realistic and less volatile guide. Year on year the growth rate in the third quarter is 2.3%. Up from 2.2% in the second quarter and 1.8% last year. The economy offers steady growth, which will lead to a slow rate rise process. The possible injection of a huge tax cut planned by Trump may lead to higher short term growth but will weaken the dollar, accelerate inflation and lead to a higher trade deficit, in due course, assuming it gets over The Hill ... © 2017 John Ashcroft, Economics, Strategy and Social Media, experience worth sharing. ______________________________________________________________________________________________________________ The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of advice relating to finance or investment. ______________________________________________________________________________________________________________ If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a friend, they can sign up here ... _______________________________________________________________________________________ For details of our Privacy Policy and our Terms and Conditions check out our main web site. John Ashcroft and Company.com _______________________________________________________________________________________________________________ Copyright © 2017 The Saturday Economist, All rights reserved. You are receiving this email as a member of the Saturday Economist Mailing List or the Dimensions of Strategy List. You may have joined the list from Linkedin, Facebook Google+ or one of the related web sites. Our mailing address is: The Saturday Economist, Tower 12, Spinningfields, Manchester, M3 3BZ, United Kingdom.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed