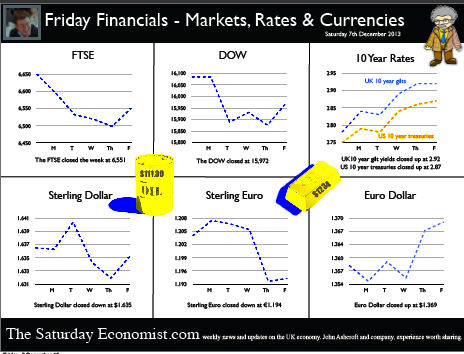

Economics news – fixing the roof whilst the sun is shining ... “Britain’s economic plan is working but the job is not done”, said Chancellor Osborne in the Autumn statement this week, “we need to secure the economy for the longer term”. Yes the Chancellor is intent on fixing the roof despite the sunny OBR outlook. The office for Budget Responsibility has revised up forecasts for the economy with growth of 1.4% expected this year and 2.4% next. Better still, borrowing is expected to fall significantly. The government is expected to borrow £111 billion this year, falling to to £96 billion next year, then down to £79 billion in 2015-16. By 2018-19, the OBR forecast the government will not have to borrow anything at all. Back from the brink of bankruptcy indeed. Growth is up, the deficit is down, unemployment is down, inflation is falling, spending will be kept under control, the government has an economic plan that is working. Who said the pasty tax was such a bad move? We even expect a much stronger performance from investment over the next two years. Just the trade figures alone will continue to disappoint. “Britain is currently growing faster than any other major advanced economy”, [which of itself will create a significant balance of payments problem for the UK economy]. "Exports are growing but they are not growing as fast as we would like", said the Chancellor. The Prime Minister’s visit to China this week is the latest step in this government’s determined plan to increase British exports to the faster growing emerging markets. We are even offering pig semen, to boost pork output in the Chinese economy apparently. So this Autumn Statement is fiscally neutral across the period. No giveaways. Government will ensure that debt continues to fall as a percentage of GDP. This means capping welfare to keep it under control and extending the working life to limit pension payments over the longer term. Business rates are to be capped, with some reduction in department spending to offset the revenue loss. The Bank levy will be increased slightly and the troops will be brought back from Afghanistan, saving lives and money in the process. All in all, this is a play it safe spending review, with a strong recovery in process. Fixing the roof, whilst the sun is shining. Yes, the sun has got his hat on and the Chancellor has a smile on his face” PMI Markit Surveys The good news continued from the PMI Markit Survey data this week, with manufacturing, construction and services all continuing to show strong growth. The recovery is extending across all sectors. Even the slow march of the makers will begin to pick up some speed this quarter. Over in the USA In the USA, growth figures for the third quarter reveal the economy grew by 1.8% year on year in real terms. The US economy will grow by around 1.8% this year, that’s actually faster than the UK but who would want to trouble an Autumn statement with facts. In the USA, more good news, unemployment data in the US fell faster than expected last month. 203,000 jobs were created in November pushing the unemployment rate down to 7%. Tapering is back on the agenda, with some speculation the cut back could begin this month. Courtesy would suggest the decision should await the move to Planet Janet in the New Year. Either way, tapering will begin soon and US base rate rises may be in prospect in 2015. What happened to sterling? The pound closed at £1.6346 from £1.6360. Against the Euro, Sterling closed at €1.1922 from €1.2045. The dollar moved down up the yen closing at ¥102.8 from ¥102.4 and closing at 1.3700 from 1.3582 against the Euro. Sterling is on a rally which has led to a break out above £1.60, but €1.20 still presents significant resistance. Oil Price Brent Crude closed at $111.61 from $109.65. The average price in December last year was almost $110. Markets, were tapered - The Dow closed at 16,020 from 16,086. The FTSE closed at 6,552 from 6,650. 7,000 FTSE now a tough call before Christmas. The markets are nervous until tapering begins. UK Ten year gilt yields closed at 2.91 from 2.78 US Treasury yields closed at 2.86 from 2.75. Yields will test the 3% level over the coming months but this may await the New Year. Gold closed at $1,231 from $1,252. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Monthly Markets updates coming in the New Year. John Join the mailing list for The Saturday Economist or why not forward to a colleague or friend? © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed