|

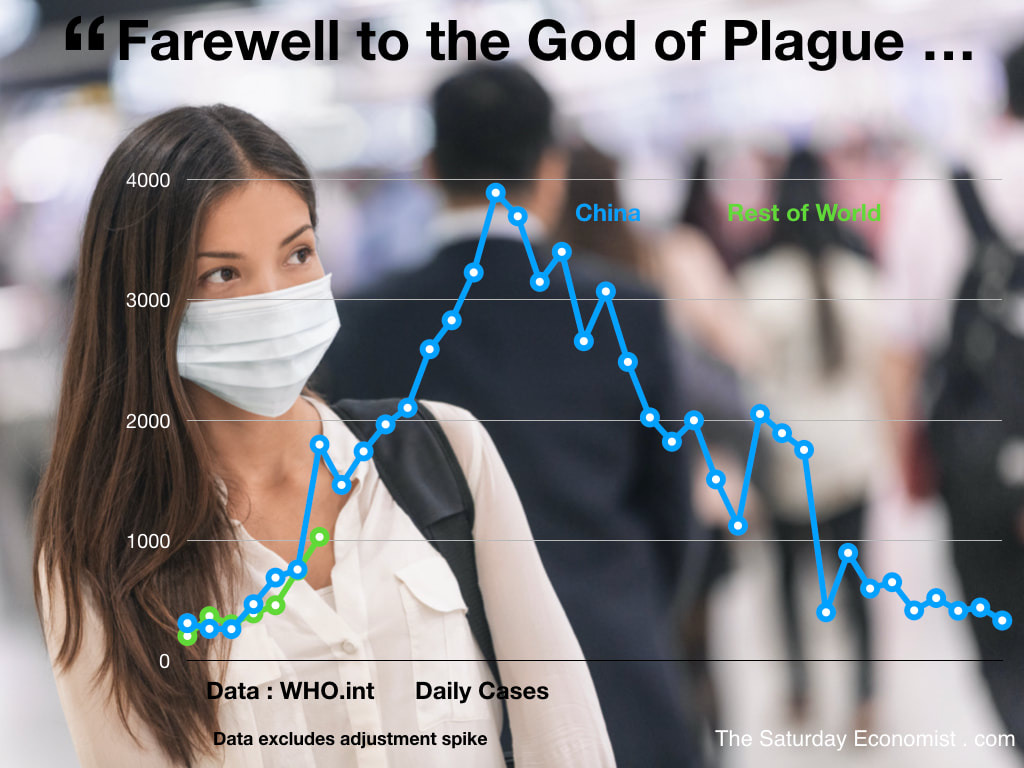

The number of cases of Corona virus increased to 83,652 yesterday. The increase day on day was 1,352. The China case load increased by just 331. The number of cases in the rest of the world increased by 1,027.

Barring a herald wave, China appears to be saying goodbye to the "God of Plague". As in Mao Zedong's poem in 1958 ... "The Spring wind blows amid profuse willow wands, we ask the God of Plague, where are you bound?" Japan, Korea and Northern Italy appears to be the answer. The greatest case acceleration is in Korea and Italy. In the UK plans are under preparation to allow schools to increase class sizes and to use Hyde Park as a morgue. With just 16 cases reported to date, the preparations may appear to be just a little premature. The mortality rate, using the data within China, appears to be around 3.5%. Mass burials in London are unlikely any time soon. Markets experienced a greater slaughter this week. The Dow was down by 3,500 points, almost 12%. The NASDAQ and S&P fell by 10% and 11% respectively. It was a similar story in Europe. Leading indices in the UK, France and Germany were off by almost 12% in total. In the East markets were more sanguine. Chinese equities, were up slightly in the month and Hong Kong stocks held firm. Commodity prices including Gold, Copper and Oil came under pressure. Sterling closed lower against the Dollar and the Euro. So what happens next? My reading this week, included a revisit to Galbraith's "Great Crash of 1929" and Laura Spinneys "The Pale Rider: The Spanish Flu of 1918 and How it Changed the World". The Spanish Flu claimed over 50 million lives. The Great Crash led to the Great Depression of the 1930s. We ask of the markets "Where are you bound"? Some consolidation was expected following the bull run last year. NASDAQ appears to be still a little over extended. This is no great crash, and Covid-19 is not the Spanish Flu. The outbreak will bring tragedy to some families and this is to be regretted. Containment of 60 million people in China confined the infection to just 0.125% of the population. Fears of a mass outbreak in the UK with a population of 67 million would appear to be wide of the mark. Data from the World Health Organization Daily Situation Reports. My thanks to Laura Spinney and The New Statesman for the reference to the God of Plague. Cummings and Goings ... Sajid Javid delivered his resignation speech from the back benches this week. The plan to merge the advisory teams within Number Ten and Number Eleven were not in the national interest he claimed. The requirement for the Treasury teams to speak truth unto power would be undermined by the move. Ministers should have the right to appoint their own team of special advisors he stated. "It has always been the case, that advisers advise, ministers decide and ministers decide on their advisers." Javid found the terms of continuance unacceptable. In his resignation letter he had told the Prime Minister, "it is important as leaders, to have trusted teams that reflect character and integrity". This was a veiled hint at the perceived shortcomings of Dominic Cummings. Javid will forever be known as the CHINO chancellor who never had the chance to deliver a budget. This week, he made some headway, challenging his successor to stick within the fiscal rules but also to cut taxes. His own plan would have been to cut income tax by 2p in the Pound, reduce stamp duty and to introduce generous reliefs for capital investment. In a clear message, "A huge signal for working people that government was on their side" Javid explained, he intended to reduce the basic rate of income tax from 20% to 18% and to set an ambition to cut it to 15% by the end of parliament. The cuts costing some £10 billion a year, rising to £25 billion within five years would be added to the additional £100 billion of current spending already announced by the Prime Minister and the further plans for an additional £100 billion of fixed capital investment on infrastructure. "I very much hope the new Chancellor will be given space to do his job without fear or favour and I know my right honourable friend for Richmond (Rishi Sunak) is more than capable of rising to the challenge". He obviously felt the new Chancellor of the Exchequer needed a little help along the way. This year borrowing is set to increase to around £44 billion. The IFS has warned the increase in the next financial year will be almost £60 billion. The revision to tax and spending plans will call for greater creativity in defining as set of fiscal rules to accommodate profligacy and prudence. It remains to be seen if Rishi Sunak is truly capable of rising to the challenge ... That's all for this week, have a great weekend. We will be back with more news and updates next week.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed