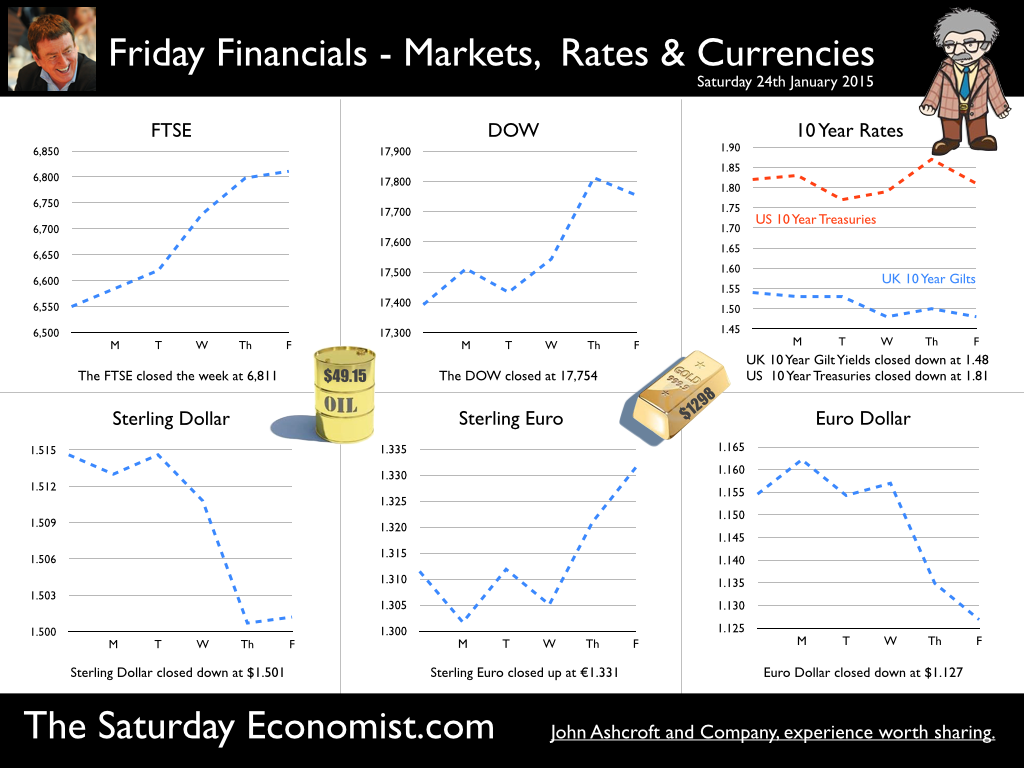

The Euro slumped to €1.127 against the Dollar this week. The Pound soared to £1.33 against the synthetic. Markets rallied, Bond yields fell. Now you can invest in Euroland bonds, with negative real yield and investment worth less on redemption than cost of acquisition. Welcome to the world of Planet ZIRP. Draghi has blown up the runway, ensuring no base rate take off is planned for at least two years ahead. Merkel kept mum, [sie sich auf die Zunge beißt] as Draghi announced the € trillion Euro plan to stimulate the stagnating economy. Mark Carney, governor of the Bank of England, called the ECB's action a "welcome step" and "absolutely necessary to preserve the prospects of medium-term prosperity in Europe". Markets loved the move, so long awaited. Volatility, volume and variance delivered across the world with juicy trader margins! What’s not to like. €60 billion of government bond purchases, each month from March 2015 until the end of September 2016. The move is planned to “strengthen demand, increase capacity utilization and support money and credit growth - thereby contributing to a return of inflation rates towards 2%.” OK, QE will lead to higher bond prices, lower yields and a weaker Euro. The latter in turn will increase inflationary pressure and may lead to a marginal increase in export volume. But what of domestic demand, especially amongst the Olive branch members? The jury is out. The evidence of QE success in the UK is not supported by spurious accuracy derived from dubious econometrics. For the moment, enjoy the move, a late ski holiday, avoiding Switzerland, the best option. So what happened in the UK this week? Golden Quarter ends on a high for retail sales … Retail sales increased by 4.3% in December compared to prior year. The surge in sales on Black Monday prior month, did not deprive retailers of a great end to the golden quarter. In the final three months of the year, volumes increased by 5.1% up by 3.9% for the year as whole. On line sales volumes increased by 8% accounting for just over 11% of all retail activity. Non food sales were up by 6.7% with particularly strong growth in household goods stores. We are forecasting total sales volumes of 3.5% in 2015, which may prove a little on the low side as real incomes improve through the year. With inflation set to average 0.8% in 2015, real income growth may well push volumes higher. Public Sector Finances December, some way to go if OBR targets are to be met … In December 2014, Public Sector Net Borrowing was £13.1 billion, an increase of £2.9 billion compared with December 2013. For the year to date, borrowing was £86.3 billion, a decrease of £0.1 billion compared with the same period in 2013/14. In December, central government expenditure included a £2.9 billion European Commission budget contribution. This expenditure increased the deficit, offsetting an overall modest improvement in underlying performance. Revenues in the year to date were up by 2.2% with a similar rise in expenditure up by 2.1%. VAT receipts were particularly disappointing in December, despite a 4% rise year to date. The interest bill will increase to over £50 billion in this financial year with a reduction in the gilt yield redemption from the Bank of England (year on year), exacerbating the problem. The Chancellor still has some way to go if the OBR targets for the year are to be met. The EC bill upset the recovery plan in December. Great hopes are placed on tax revenues due in the final quarter of the year. The best may have been left for the election run up! Continued improvement in Labour Market Data points to strong growth in Q4 … The UK labour market continued to improve, according to data released by the Office for National Statistics (ONS) today. The strength of the UK recovery continues into the final quarter of 2014. In December the claimant count fell to 868,000 and a rate of 2.6%. Over the year the claimant count number has fallen by 370,000. For the three months to November 2014, the wider LFS unemployment rate stood at 5.8%, sharply down from 7.1% over the same period 12 months ago. This is the lowest rate of unemployment since August 2008. Vacancies increased to 700,000, that’s higher than the levels achieved pre recession. The U:V ratio (Unemployment to Vacancies) fell to 1.24, approaching the levels last seen in the first quarter of 2008. Earnings increased averaging 1.8% in November. Construction and private sector earnings increased by 2.1%. With inflation falling to 0.5% in December, real incomes will receive a boost which will underpin the recovery into 2015. The data provides further evidence of the strong recovery in the UK into the final quarter of the year. We expect growth of almost 3%, to continue into 2015 and 2016. Unemployment rates are reaching levels last seen pre recession. The implications for skills shortages and rising pay rates are significant. The labour market is tightening, the capacity gap is evaporating. So what happened to Sterling this week? Sterling closed slightly down against the Dollar at $1.501 from $1.515 but moved up against the Euro to €1.331 from €1.311. The Euro closed down against the Dollar at €1.127 from 1.155. Oil Price Brent Crude closed steady at London close at $49.15 from $49.48. The average price in January last year was $108.126. Markets, moved up. The Dow closed at 17,754 from 17,392 and the FTSE closed up at 6,811 from 6,550. UK Ten year gilt yields moved down to 1.48 from 1.54. US Treasury yields fell to 1.81 from 1.82. Gold closed at $1,298 ($1,276). That’s all for this week. Check out our Oil Market Update to understand what's happening to prices. Don’t miss the Great Manchester Business Conference in March, The Social Media Conference in July and the Economics Conference coming to Manchester in October. It’s a great line up for all of the events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed