|

Phil Aldrick reports of a mugging in Downing Street this week. The Chancellor received help from Treasury and the OBR to convince the Prime Minister it was time to dig up the magic money tree in the rose garden.

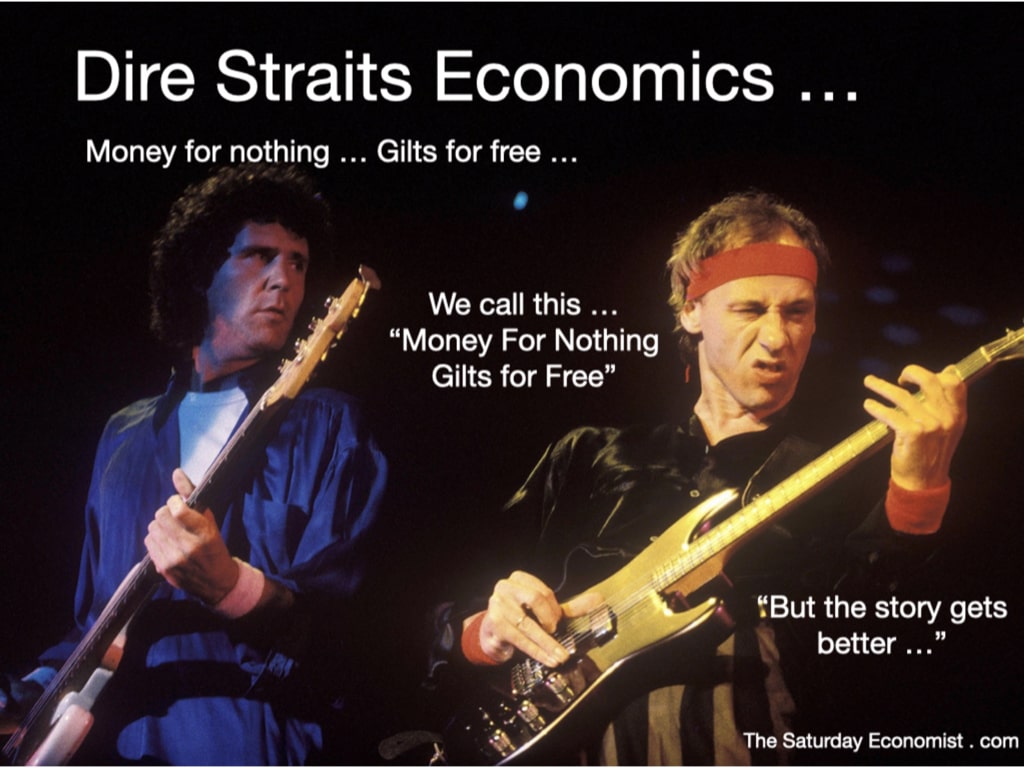

Within days, Sunak was warning of a possible end to the triple lock, an end to furlough scheme and an end to the universal credit coupon. No money for the Biden's Global Belt and Braces initiative, money had to be found for building batteries in the UK. Does the state have any “fiscal space” left? Yes, the OBR said, because the Bank of England can buy the debt issued by the government! No talk of QE, a clear admission of the process of monetary financing of the fiscal deficit. We call it Dire Straits Economics, money for nothing, gilts for free. Plus we don't even have to worry about repaying the debt. Here's why ... In 2008 we warned of the dangers of monetary policy. Rates at the zero bound could leave us 'trapped on Planet ZIRP'. Rate hikes on the Planet have led to more than one flight cancellation in the past. In 2021, central banks are still struggling to raise rates. The process of tapering will have to be delayed. In 2012 we asked and explained what's wrong with QE. Central banks were buying gilts and bonds. Purchases were pushing up prices and lowering yields. Central Bankers were creating the biggest bond bubble in history according to Andy Haldane Chief Economist at the Bank. By 2020, the language of "QE" was abandoned. Andrew Bailey, Governor of the Bank of England admitted the Bank was acting as the "Buyer of Last Resort", acquiring monetary assets from the Debt Management Office. Without central Bank intervention, 'the government would have struggled to fund itself', said Andrew Bailey in an interview with Sky News in April last year. In June this year, the Governor explained, The Bank of England Monetary Policy Committee voted this week to keep rates on hold and to maintain the existing target of UK government bond purchases at £875 billion. No mention of QE. QE is dead. Central banks cannot as yet raise rates. A reduction in the rate of asset purchases, the process of tapering, cannot begin, until the level of government annual borrowing falls within the capacity of independent financial institutions and the appetite of overseas holdings. UK Insurance companies and Pension Funds picked up just over 5% of new gilts issued in 2020. Their share of total holdings fell to 28% from 58% at peak before central bank intervention began in 2009. In 2020, the Bank acquired almost 70% of new debt issued by the DMO. By the end of the year, the Bank of England stock of government gilts increased to almost £800 billion according to the Debt Management Office. The Bank had become the largest owner of UK debt accounting for 32% of total issue. The promise of the Chancellor's £1 trillion pound bank note will soon be filled. The Treasury creates the borrowing need, the Debt Management Office issues the debt. The Treasury, underwrites the Bank of England purchases. The coupons paid on the Gilts held by The Bank of England are remitted, paid back to the Treasury. We call this Dire Straits Economics" "Money for Nothing Gilts for Free". Better still, the debt, the liability owned by the Treasury, is an asset owned by the Bank of England. Both are owned by Her Majesty's Government. Inter-group consolidation at some date in the future would imply that £1 trillion of government liability could just fade away. No need to worry about the debt burden for your children, grandchildren and great grandchildren and generations beyond. Like old soldiers, the gilts will lose their shine and just fade away. That's the real beauty of Dire Straits Economics. Want to know more? You can access and download the slidedeck with video clips on the Saturday Economist Club Web Site. Become a Premium Subscriber, you will have access to the pack ...

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed