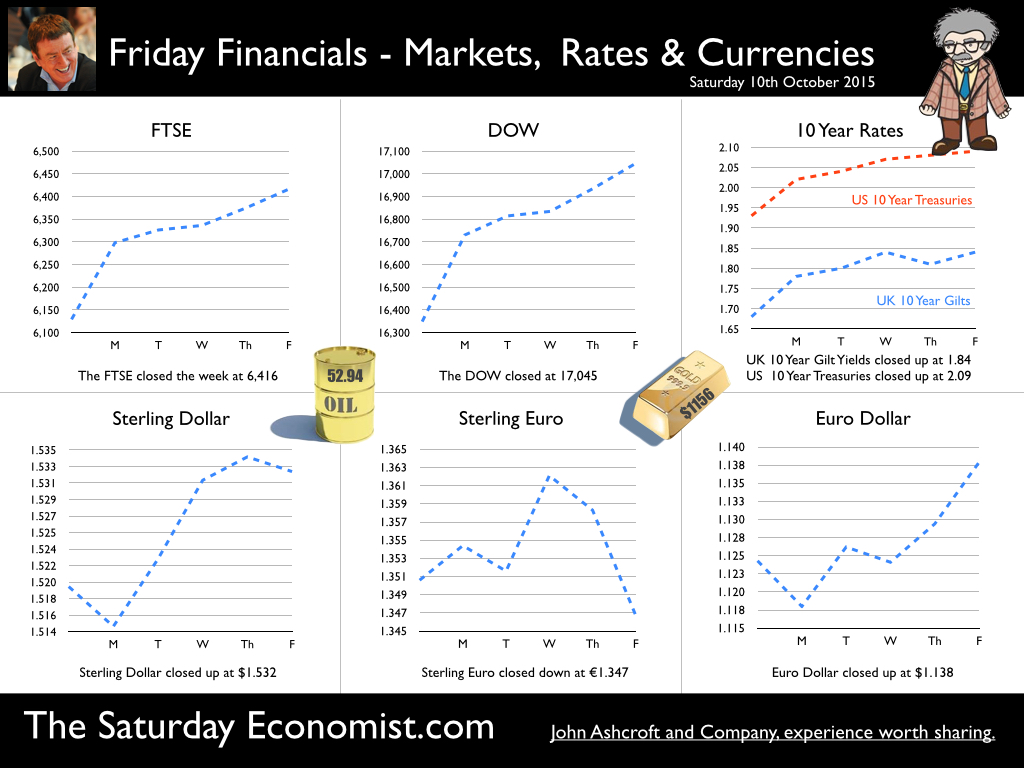

Brothers and Sisters, there is still much to do … Christine Lagarde head of the IMF was in Peru this week. The latest update from Washington had been pretty gloomy. Growth in 2015 had been down graded to 3.1%, the lowest since the financial crisis. The warning was of a clear and present danger to emerging markets, from the imminent monetary policy adjustment in the West. Larry Summers, Harvard Professor and former advisor to President Obama pulled no punches. The global economy is in serious danger screamed the headline in the Washington Post on Wednesday. “The problem of secular stagnation is growing worse in the wake of problems in most big emerging markets, starting with China” he said. If only we knew what secular stagnation is, we might be able to do something about it. It’s two random words thrust together as a revamped Keynesian Liquidity Trap. To suggest the dangers facing the global economy are more severe than at any time since the Lehman Brothers bankruptcy in 2008 is exaggerating the problem to grab a headline. Not for the first time this year Professor Summers has cried Wolf. Not to worry. Christine Lagarde, is on the case. Quoting the Peruvian poet César Vallejo “Brothers and Sisters there is much to do”! The IMF has a list and is on the case. Sending more positive messages about world growth prospects would help. The time is right for the West to leave Planet Zirp and begin the rate rise. Central banks in the US and the UK should act now whilst some semblance of control over economic events persist. Moderate inflation is coming, rates must rise. Sure, the ramifications, for capital flows, exchange rates and asset prices will be significant across emerging markets. The so called “spill over effects” are within the natural rhythm of an effective world capital market. Growth may or may not be slowing in China. The oil price is acting negatively on growth in Russia, Brazil, Nigeria, Venezuela and the OPEC nations generally. The oil price movement is a zero sum game. There are winners and losers. Growth in India will be higher than that of China this year assisted by low energy prices. The developed world is benefiting. The changing dynamics of world growth should come as no surprise. But how long will low energy prices persist? Manufacturing - winners and losers since recession … Oil Price ... Oil Brent Crude closed above $50 this week. If prices hold at current levels, oil prices will be 11% higher year on year towards the end of 2015 and into January. The impact will quickly be reflected in manufacturing prices and consumer prices in the UK and across the world. Chinese imports of oil were up 10% year on year in the period to August according to the All China Market Research Company. The Number of US oil rigs has fallen to 600 from a prior peak of 1600 in October last year, as output tumbles. Conflicts in the Middle East, Russian bombs into Syria, Nato troops into Turkey. The potential for an oil price explosion is evident given geo political tensions, strong demand, a supply squeeze and a slight nudge from OPEC. Commodity prices are adjusting to over supply. The mists will slowly clear over the underlying Chinese growth rate this year and next. In farming it is said, the best cure for low prices, is low prices! And so it will prove into 2015. Energy and commodity prices will rally as strong growth continues across the world. So what happened in the UK this week … Trade Figures … The trade figures in August were disappointing but should come as no surprise to readers of The Saturday Economist. Month on month figures can be misleading and subject to revision. A trade in goods deficit of £125 billion is in prospect this year compared to a revised £123.7 billion last year. A service sector surplus of £95 billion will mitigate the problem. The overall trade in goods and services deficit just under 2% of GDP will not present a threat to growth at this stage. Manufacturing … The latest data from the Office for National Statistics continue to present a gloomy outlook for the manufacturing sector. Output in August fell by 0.8% following a drop of -1.2% in July. We expect manufacturing output in Q3 to fall by 1% compared to the same period last year. For the year as a whole, we now expect growth of just 0.5% in the current year compared to growth of 2.7% last year. Next year we forecast a slight improvement with growth up by 1.5%. That’s more or less in line with the long run [fifty year] average. The march of the makers will be unable to rebuild the workshop of the world any time soon and won’t hit the government £1 trillion export target by 2020. Overall manufacturing output remains some 7% below the pre recession peak and in line with levels experienced sixteen years ago, at the end of 1989. We expected too much from manufacturing in the re balancing agenda. The average rate of growth since 1950 has been just 1.5% hence the share of output decline in an economy growing at 2.5% plus. We analyse some fifty sectors in manufacturing. Strengths in food, beverages and transport equipment are high growth areas compared to the overall trend. Check out our manufacturing update for October to understand more about the vagaries of manufacturing in the UK. Available from the web site. So what of growth this year … We still expect the UK to grow by 2.8% this year and into next. Based on current data 2.6% is in prospect but we expect revisions at some stage to push the final out turn higher. Growth above trend in three consecutive years, rising wages, a tightening jobs market and rising energy inflation are inconsistent with base rates at 0.5%. A rate rise will come into focus towards the end of the year. So what happened to Sterling this week? Sterling moved up against the Dollar to $1.532 from $1.519 and moved down against the Euro to €1.347 from €1.351 The Euro moved up against the Dollar to €1.138 from 1.135. Oil Price Brent Crude closed at $52.94 from $48.00. The average price in October last year was $87.43. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, up this week! The Dow closed at 17,045 from 16,348. The FTSE closed up at 6,416 from 6,129 Gilts - UK yields bounced. UK Ten year gilt yields were at 1.84 from 1.68. US Treasury yields moved up to 2.09 from 1.93. Gold moved up to $1,156 ($1,135). That's all for this week. Enjoy the rest of the week-end. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed