|

What's Wrong With Economic Forecasts at The Bank of England

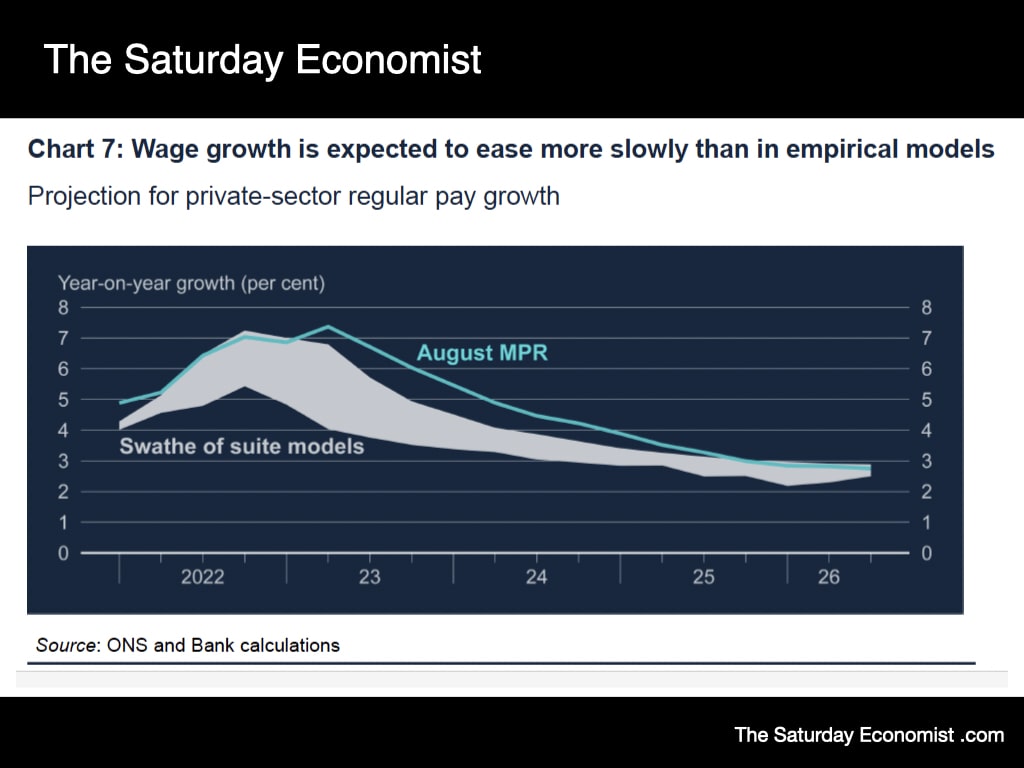

The governor revealed this week, the MPC has a "Swathe of models" just to forecast wages. The economics team delivers the model forecasts, then the committee decides on a completely different "best view" guess. So how good are the guesses? The Bank of England has called in Ben Bernanke, former chairman of the US Federal Reserve and a joint winner last year of the Nobel prize for economics, to review the way in which the Bank goes about forecasting (and the guesswork). The appointment comes as the Bank faces criticism for its efforts to control soaring inflation and failure to predict the surge in prices. Governor Andrew Bailey said "Bernanke will lead a review into the Bank’s forecasting and related processes, assisted by the Bank’s own independent evaluation office. The process should be completed next spring." Dr Bernanke is a renowned and award-winning economist whose distinguished career makes him the ideal person to lead this review." Many will remember Bernanke was head of the Fed, when the world economy crash landed onto Planet ZIRP. As we wrote at the time "Welcome to life on Planet ZIRP. Unfortunately we do not have a guide book. We do not full understand the terrain. Helicoptering more could be just like dropping water in the desert, such are the fissures in the financial system. Rates at the zero bound, could leave us trapped on Planet ZIRP for some time." In Bernanke's policy response, short term rates of interest came very close to zero in the aftermath of the global financial crisis. This drove the Fed and other central banks towards a range of “unconventional” policies, including large-scale asset purchases, generally known as “quantitative easing” and “forward guidance” on future monetary policy. So what hope for the model evaluation? Jagjit Chadha, director of the National Institute of Economic and Social Research, argues that the problem is not so much with the Bank’s model, as the way it was used. The model can give a central case and the balance of risks ... “The Bank’s failing was not to articulate the risks and failing to act promptly in response. It is less a models’ problem and more one about how to use information and communicate narratives.” The problem would appear to be much more complicated than this. There is not just one model. The governor yesterday revealed this week, the MPC has a "Swathe of models" just to forecast wages. The economics team delivers the model forecasts, the committee then delivers a completely different "best view" guess. As the Governor explains, Chart 7 shows a swathe illustrating the range of forecasts from a swathe of such wage models maintained by Bank staff, along with the MPC’s projection for private-sector regular wage growth. In the MPC projection, which reflects the MPC’s best collective judgment, wage growth is expected to ease more slowly than these models would predict." "Earnings" just one of the hundreds of parameters in the model set. Over ten years ago, the Bank's core macro econometric model consisted of about 20 key equations determining endogenous variables. With a further 90 or so identities defining relationships between variables and about 30 exogenous variables for which paths have to be developed. The models have become much more complicated since then. At least 150 variables with an average of six model options, would create almost 1000 model equations to be assessed. David Smith writing in the Times suggests "Anybody thinking that Bernanke will be able to advise on tweaks to the Bank’s economic model to make bad forecasts a thing of the past is fooling themselves." Not too worry. It's going to be the Spring next year before we get the results ... by then inflation will have fallen to around 3%. The forecasting crisis will be over. That's if the Bank of England model is correct ...

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed