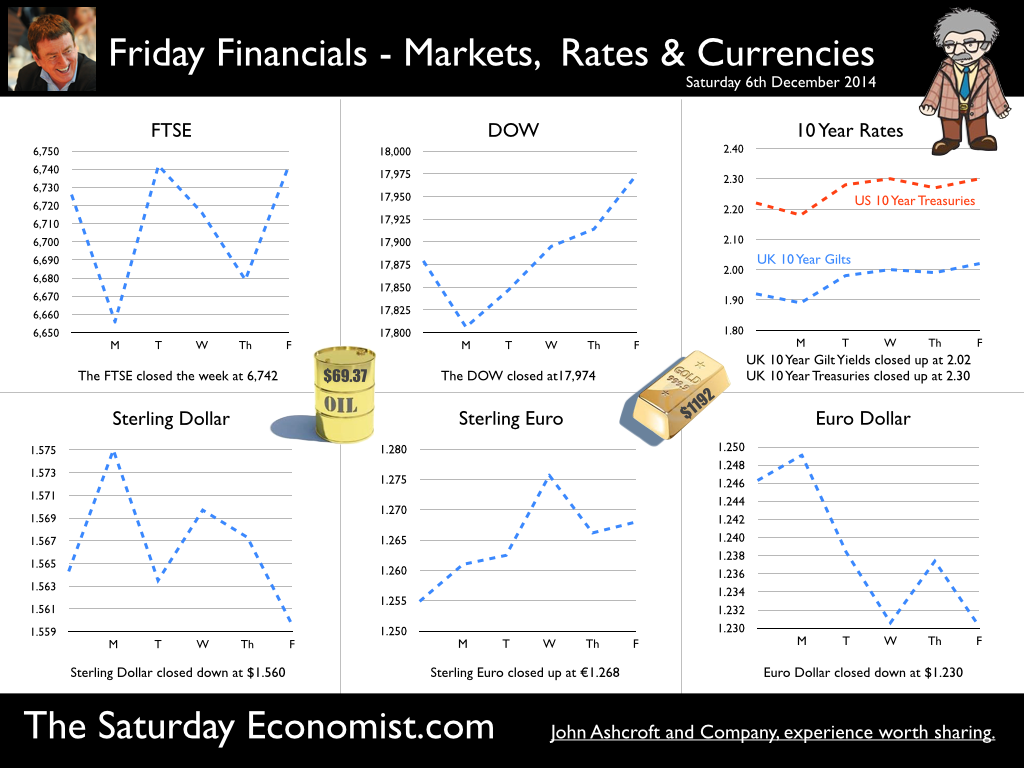

This week, the Autumn statement from the Chancellor of the Exchequer plus the OBR’s update on the Economic and Fiscal Outlook for the UK Economy. The OBR upgraded their growth forecast for the current year to 3%. This is in line with the consensus view although still somewhat behind the bulls at the Bank of England. The latter still convinced the ONS will revise up estimates to Threadneedle Street levels (3.5%) sometime in the future. Looking forward to next year and beyond the OBR is quite pessimistic. Growth is expected to fall to 2.4% then 2.2% over the next two years. Our own forecasts, based on our GDP(O) model suggest growth will be around 2.7% next year and beyond. Fears for productivity growth are much overdone. With supply elasticity, much greater in a service sector economy, we expect reversion to a trend rate of growth or around 2.7% quite plausible over the medium term. Revisions to Growth … Does this matter? Of course, the revisions to nominal GDP could be worth around £100 billion over the next four years, improving the tax take to the exchequer by £35 billion to £40 billion. So much for austerity. With much of the reductions in spending still yet to take place, an upward revision to growth would make the burden much lighter on spending plans. As it is, the Chancellor was obliged to announce the failure to hit borrowing targets in the current year. The OBR is forecasting a reduction in the financial year to £91.3 billion compared to £97.5 billion last year. Not bad considering there was an significant overspend at the half way mark. Borrowing is set to fall to £75.9 billion in 2015/16 and £41 billion in the following year. The forward plans look realistic and achievable over the next three years. Will we be in surplus by 2020 by over £20 billion? Well I doubt that! Autumn Statement … a political master stroke ... The Autumn statement was once again a master stroke of politics over reality. With little to give away, the tax take from Banks and Google, grabbed the populist headlines and the Stamp Duty shuffle provided an overnight boost to the housing market. In the North we are blessed with plans for Research Institutes, theatres and infrastructure. Fill their heads and fill their potholes the pre election platform! Elsewhere in the World … At some time this week, the Bank of England made an announcement about rates. No one seems to take much notice any more. The man from Waterloo station should add the monthly statement to his announcements about arrivals and departures. It might provoke wider engagement. In the USA, 321,000 jobs were added to the non farm payroll in November. We expect a revision to US growth for the year, to almost 2.5% to follow in due course. The US is enjoying a strong recovery despite fears of withdrawal symptoms post QE. In Europe, Draghi continues to drag his feet on the introduction of QE across the Eurozone. The Bundesbank has cut the forecasts for German growth in 2015 to just 1% next year despite more optimistic survey data from the manufacturing sector. Across the Eurozone, The ECB now expects growth of 0.8 per cent this year, 1 per cent in 2015 and 1.5 per cent in 2016. Inflation forecasts were also lowered, with the ECB now predicting prices to rise 0.5 per cent in 2014, 0.7 per cent in 2015 and 1.3 per cent in 2016. Inflation is always and everywhere an international phenomenon, with energy prices, pushing costs lower. Oil Prices continue to languish below $70 dollars Brent Crude Basis this week. Sheiks versus shale, is the headline in this week’s Economist. The Economist is talking of the “New Economics of Oil” suggesting low prices are here for the medium term! Our long shot call last week, is looking like a misfire. It’s all about cost platforms. But what is the marginal cost of oil extraction, or drawing a glass of water from the tap for that matter? It could be a long short! So what happened to sterling this week? Sterling closed down against the dollar at $1.560 ($1.564) but moved up against the Euro to 1.268 from 1.255. The Euro closed down against the dollar at €1.230 from (€1.246). Oil Price Brent Crude closed down at London close at $69.37 from $72.73. The average price in December last year was $110.76. Are we right to still expect one last squeeze to flush out the timid? The intra day sub $70 last week could well have marked the move but obviously didn’t. Sheiks versus shale, East versus West, The Putin Put?, the squeeze continues. Markets, moved up. The Dow closed at 17,974 from 17,879 and the FTSE closed up at 6,742 from 6,726. Our call is for 7,000 in the Christmas stocking! Or maybe New Year? We shall see! Mining and Commodity majors feature in the UK market profile forcing a DOW - FTSE divide. UK Ten year gilt yields moved up to 2.02 from 1.92. US Treasury yields were up to 2.30 from 2.22. Gold moved up to $1,192 from $1,181. That’s all for this week. Plans are proceeding for the Great Manchester Economics Conference in October next year. Bridget Rosewell joins the line up this week alongside Linda Yueh, Diane Coyle and Kate Barker. Watch out for updates and news of early bird ticket deals in due course. Interested in Social Media? Profiled on LinkedIn? Check out our PhD in LinkedIn Guide now available from Amazon! Join the mailing list for The Saturday Economist or why not forward to a colleague or friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed