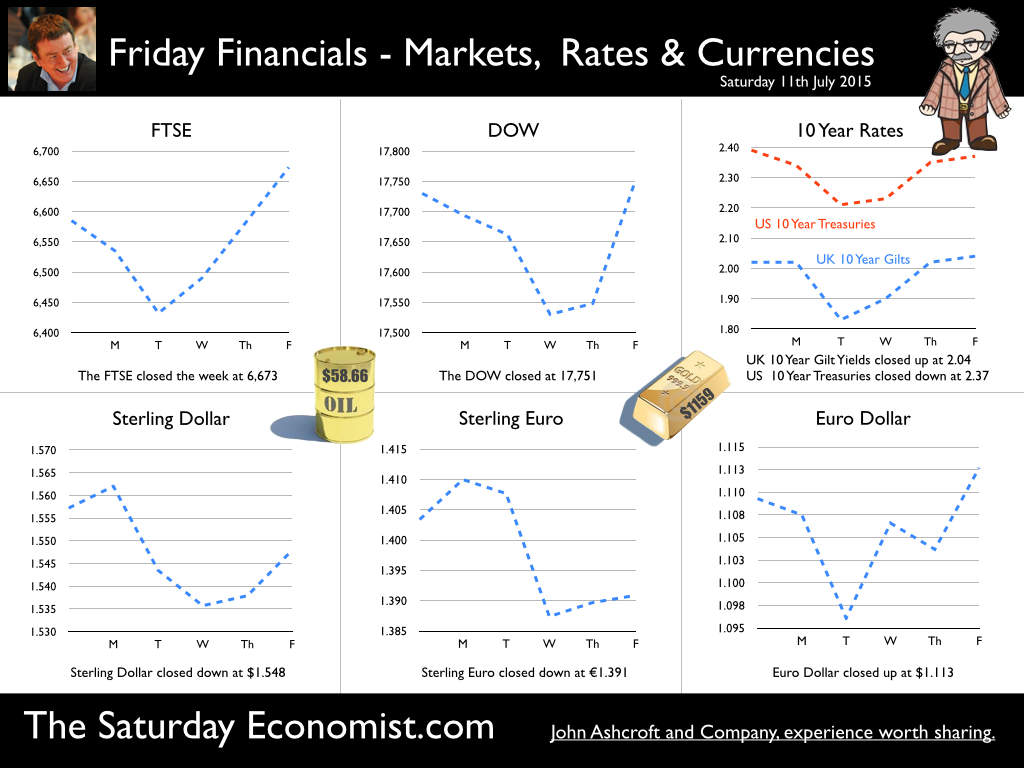

Greek Crisis The Greek Prime Minister Alexis Tsipras gained backing from Parliament for the tough austerity proposals now on offer from the Troika creditor countries. The leaders of the Eurozone and the broader EU are due to meet in Brussels on Sunday to discuss the way forward. The French more conciliatory than the Germans in a desire to resolve the impasse. That’s laissez-faire for you. The Greeks in pursuit of a haircut and something for the week-end have been disappointed this week. Uncle Sam will be listening in tomorrow, a deal looks likely. The cash will surely begin to flow next week and quite right to. Lots of time to pick up the flotsam and jetsam as a result of the IMF rule book. Can anyone understand the attraction of a 23% VAT rate? UK Budget It was the UK budget this week. The Conservative party budget delivered a few surprises, not least a big increase in the living wage. Chancellor Osborne is set to balance the books, disrupting private sector payrolls in the process. The OBR forecast is for borrowing to fall to £69.5 billion this year and £43 billion next. A return to surplus now expected by 2020. Total debt will now peak at just over £1.6 trillion. Higher personal allowances and higher rate thresholds increases would cost the Exchequer £1.3 billion. A pension relief claw back would balance the giveaway. Lower corporation tax rates and higher investment allowances would be funded by a further banking levy, dividends tax and insurance premium tax. Welfare cuts and reductions in tax credits are expected to deliver savings of over £3 billion this year and £4 billion next. Painful cuts on the front line. Tough love offset by a big increase in the minimum wage. A National Living Wage, starting at £7.20 and rising to £9 an hour by 2020, replaces the £6.50 minimum wage for those over 25. A commitment to defence spending at 2% of GDP assisted sentiment on the Tory back benches. The Chancellor will have to come to terms with the implications of the wage hike. Job losses are expected to be contained to just 60,000. The impact on inflation incalculable as yet. So what to make of it all? A big agenda, unimpeded by coalition hackles outmanoeuvring the left in the process. The government is set to balance the books by 2020. Higher growth and higher inflation could get us there sooner … In other economics news … The construction figures were released this week. Output in the construction industry showed an increase of 1.3% compared to May last year. All new work increased by 3.2% while repair and maintenance decreased by 1.7%. The May data is well below our expectations for the year. We expect construction output to increase by 4% for the year. Manufacturing output increased by just 1% in May. A big surge in oil, gas and extractives, increased production output by 2.1%. We still expect manufacturing growth of just over 2% this year. No rebalancing on the agenda with (private) service sector growth increasing at 4%. Trade in Goods … hopes for rebalancing on the trade front surged. The deficit trade in goods and services fell to £0.4 billion in May, compared with £1.8 billion in April 2015. A deficit of £8.0 billion on goods was partially offset by an estimated surplus of £7.6 billion on services. This deficit is the smallest since June 2013. The narrowing a result of imports decreasing by £1.4 billion to £43.4 billion. Exports were unchanged at £43.0 billion. Imports of goods decreased by £1.4 billion in May 2015 to £32.6 billion, the lowest level since April 2011. Most notable decreases were evident in the imports of ships and materials. Will the trend be sustained? Not really. Big boats and surges in metal stocks do not of themselves suggest a trend. Lower oil imports and prices helped. We still expect a deficit trade in goods of over £120 billion this year. China Stock Market … In other world news, time to worry about Chinese stock market bubbles and the looming debt crisis in Puerto Rico. You would think we have never seen a bubble in the Western world, such is the excitement. The best way to undermine a bear market - ban people from selling! Simps. One of the great benefits of a command economy. So when will rates rise? … In the US, Janet Yellen once again reaffirmed a commitment to raise rates this year despite the protestations of the IMF. September remains the favourite for the first rate rise with a further rate rise quite possible before the end of the year. We continue to expect a UK rate rise within three to six months of the first Fed move. Don’t rule out a UK rate rise before the end of the year. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.548 from $1.557 and moved down against the Euro to €1.391 from €1.403. The Euro moved up against the Dollar to €1.113 from 1.109. Oil Price Brent Crude closed at $58.66 from $60.39. The average price in July last year was $106.77. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. The rise in US summer stocks may threaten price levels. Markets, steadied. The Dow closed down at 17,751 from 17,730 and the FTSE closed down at 6,673 from 6,585. Gilts - yields were mixed. UK Ten year gilt yields moved to 2.04 from 2.02 US Treasury yields moved to 2.37 from 2.29. Gold moved up to $1,159 ($1,168). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now on the web site. The Early Bird deal is now open. The FIRST one hundred tickets save over £50. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed