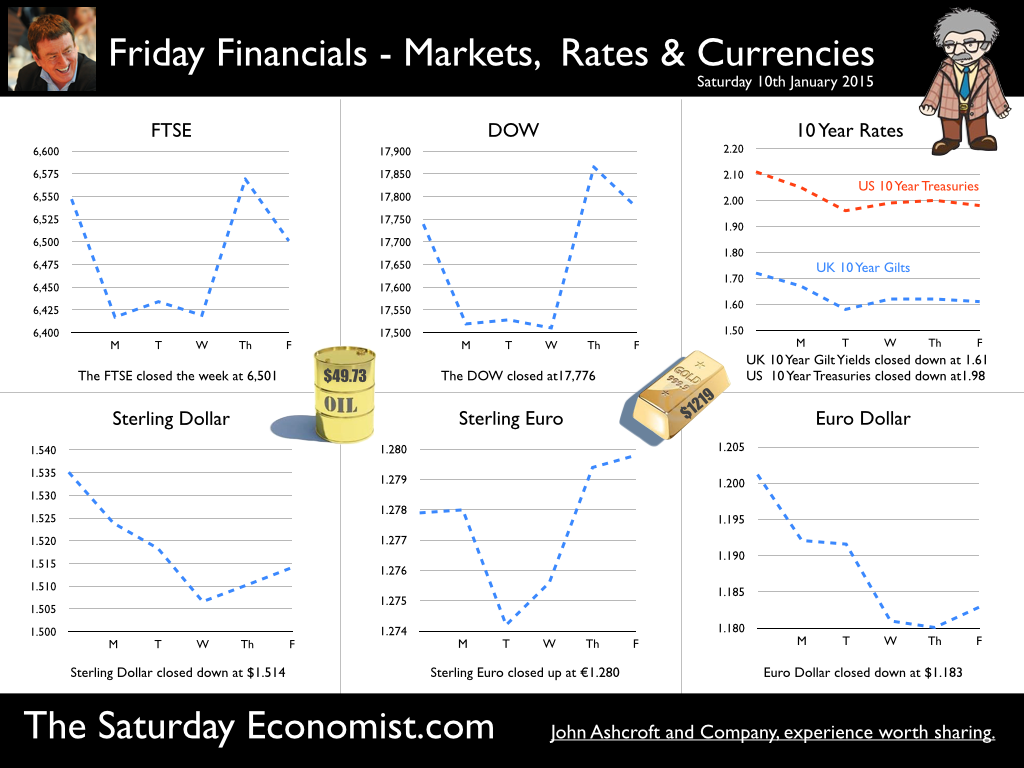

The year has certainly got off to fascinating start. The collapse in oil prices, deflation in Europe, the Routing of the Rouble, the Drama of the Drachma and the ever present threat of a Chinese implosion. Over the break, we have been struggling to get to grips with the collapse in oil prices and the late revisions to the UK GDP data - but we are getting there! GDP Revisions … Two days before Christmas, all forecasts were set, a 3% growth - a pretty safe bet but in the final revision to GDP data in 2014, the ONS revised down the estimate for growth in Q3 from 3% to just 2.6%. We now think growth for the year as a whole will be 2.8%, down on our (and the OBR) earlier estimates of 3% and way below the Bank estimates of 3.5% growth in 2014. Next year we expect the growth to continue at a similar rate. As always we caution we are not forecasting the output of the British Economy, more the output of the Office for National Statistics. Our Quarterly Economics Update with full forecasts for 2015 will be released next week. Oil Prices … Oil prices have collapsed to $50 per barrel Brent Crude basis compared to $110 per barrel earlier in the year. A slow down in China and the surge in US shale is the tabloid claim to blame but our Oil Market Update for 2015 released this week is a more comprehensive assessment of the real problems facing oil prices. What is pushing oil prices lower? Will prices stay low? What are the prospects for oil demand growth? Which countries are the winners and losers? What is the impact of lower oil prices on the economy? Are lower oil prices good for growth? What does the falling price mean for the consumer? We measure how US rigs go up as oil prices rise. The real challenge - Sheiks versus Shale and the return of the speculative bubble map, as we outlined just before Christmas. The update is comprehensive and is a FREE download ! Manufacturing, Construction and Trade … So we return to the latest economic data releases this week … Manufacturing Output rallies in November … Manufacturing output increased by 2.7% year on year in November compared to an increase of just 1.7% in the prior month. We now expect manufacturing growth to increase by 2.4% in the final quarter of the year and by 2.6% for the year as a whole. Once again, consumer durable output was particularly strong up by 6.8% (a reflection of a strong housing market). Capital goods also demonstrated strong growth up by 3.3%. Textiles and clothing continue to pull down the overall performance falling by 9.3%. Manufacturing output remains some 6% down from the peak levels of 2008. We expect manufacturing growth to continue into 2015 at a rate of 2.5% for the year as a whole. The UK recovery continues but with a continued dependence on service sector growth. Construction Output - Housing drives recovery in November … Construction output increased by 3.2% year on year in November. A strong growth in new work (up 5.6%) was offset by a subdued repair and maintenance performance falling by just under 1%. Is this a problem for growth? Not really. Housing construction increased by 23% over last year as the strong rally in the housing market continues. We forecast construction growth of just over 3% in the quarter and remain confident of strong growth of almost 4% into 2015. Trade Performance November … The UK’s deficit on trade in goods and services was estimated to have been £1.4 billion in November 2014, compared with £2.2 billion in October. A deficit of £8.8 billion on goods, partly offset by an estimated surplus of £7.4 billion on services. The narrowing of the deficit reflects a fall in imports of goods rather than an increase in exports. Most of the reduction is explained by a £0.7 billion decrease in imports of oil. In the Saturday Economist, Oil Market update, we estimate a 10% fall in the oil price will lead to a £1 billion improvement in the UK balance of payments over the year. In November the oil price Brent crude basis was down by 25%. In December, the price difference increased to over 60%! The improvement in the trade account is set to improve in the short term as a result of the oil price fall but we still expect the overall trade in goods deficit to be around £120 billion this year. As for the future, $50 dollar oil could lead to a £5 billion bonus to the trade account. However, we caution, low oil prices are just for Christmas … not for life. We expect oil prices to bounce back this year. Elsewhere in the World … USA The US economy created 252,000 jobs in December broadly in line with consensus expectations. The unemployment rate stood at 5.6% in December, compared to 5.8% prior month. US employment gains for the year as a whole remain strong. For the moment, earnings and wage growth remains weak, assuaging fears of an early Fed rate hike. Elsewhere in the World … Europe The Eurozone slipped into deflation for the first time since October 2009 as the annual change in the Consumer Price Index fell to -0.2% in December according to Eurostat data. The unemployment rate across the currency area remained steady at 11.5%. Greece and Spain have already been in deflation for some months with unemployment rates more than twice as high as the Eurozone average. In Germany unemployment has been falling (now at 6.5%) with inflation just positive at 0.2%. The pressure on the ECB to exercise some form of QE remains intense, pushing the Euro lower. So what happened to sterling this week? Sterling closed down against the Dollar at $1.5140 but moved up against the Euro to 1.280. The Euro closed down against the Dollar at €1.183. Oil Price Brent Crude closed down at $49.73. The average price in January last year was $108.126. Markets, were disturbed. The Dow closed at 17,776 and the FTSE closed at 6,501. So much for 7,000 in the Christmas stocking! Or even New Year? Or even 2015? UK Ten year gilt yields moved to 1.61 from 1.88 before the break. US Treasury yields fell to 1.98. Gold closed at $1,219. That’s all for this week don't miss The Oil Market Update and don’t miss the Economics Conference coming to Manchester in October. It’s a great line up! John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

1 Comment

|

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed