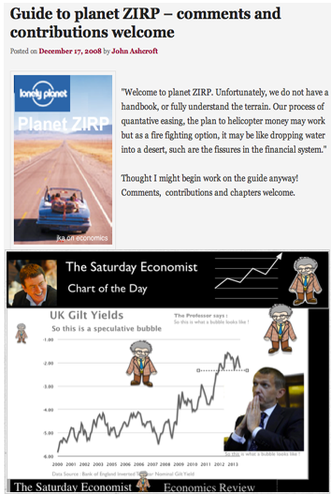

Andy Haldane warned this week : “Let’s be clear, we have intentionally blown the biggest government bond bubble in history” speaking before the Treasury Select Committee. Andy Haldane is the director of financial responsibility at the Bank of England. His views were quickly distanced by Old Lady of Threadneedle Street, as very much a “personal view”. OK bond markets may be the main risk to financial stability but best not to speak of it in public. Not to worry, the markets will get the message in the end. High bond prices and absurdly low yields are a by product of life on Planet ZIRP. With short rates at or near the zero interest rate policy level, undermining long term rates was considered to be the next great step. Who could possibly think that creating a financial climate with negative long term real rates, would encourage lending, in an uncertain business world. Well Ben Bernanke for one. There is no “Lonely Planet” Guide to life on Planet ZIRP as we pointed out in December 2008. Commenting on a paper by Bernanke - we said then - “OK it’s official, the effects of QE remain quantitively quite uncertain. Welcome to Planet ZIRP. We don’t have a hand book or fully understand the terrain. We cannot be sure QE is going to work at all. The process of quantative easing, the plan to helicopter money may work but as a fire fighting option, it may be like dropping water into a desert, such are the fissures in the financial system” We also said, “This is your captain speaking, Welcome on board flight QE 2009. I hope you have a nice flight, I am relatively new at this, haven’t actually flown before, we shall be flying by the seat of our pants but have every confidence, we will get somewhere, but not sure where, in the end.” QE was an experiment which is still five years late unproven. We warned then, Planet ZIRP, would be a desiccated sterile planet where a liquidity crisis is exacerbated and prolonged. Now, five years on, the US markets are beginning to fret about the end of the Bernanke flight, with fears of a crash landing in prospect. As Sam Fleming, warns in The Times today, “the Governor of the Bank of England, in 2009, described the process of reversing QE as completely straightforward. It is proving to be a nightmare. “ In the Saturday Economist we pointed out last week, The Bank of England has mopped up almost 75% of UK gilt purchases since QE began. There can be no reversal of QE in the UK. The gilts will be held to redemption. The real challenge - who will buy the gilts at negative real rates, now the Old Lady has to stay off the street. For earlier posts Google “Planet ZIRP - John Ashcroft” , or check out this post you had been warned! What happened to sterling? Further dollar weakness the story, this week as fears over QE3 increase. Sterling rallied to 1.5703 from 1.552 dollar basis and held at 1.1763 against the Euro. The Euro dollar closed at 1.3345 from 1.3216. Against the Yen, the dollar closed once again below the critical 100 level at 94.06 from 97.60. Oil Price Brent Crude closed at $105.93 from $104.56. In June last year Brent Crude averaged $95! The best for inflation may be over, oil prices will be up 10% this month compared to last year. Markets, The Dow closed at 15,070 from 15,248. The FTSE closed at 6,308 from 6,411. The easy calls have been made, time to stand aside whilst the markets consolidate and fret about QE. UK Ten year gilt yields held at 2.08 from 2.09 - US gilt yields closed down at 2.13 from 2.18. The great rotation - in a bit of a spin. As for gold, closed at $1,390 from $1,384. The excitement is over for now, this is a hung chart. Really pleased this week to be appointed as the Chief Economist at the Greater Manchester Chamber of Commerce. Looking forward to working with Clive Memmott, and the team in Manchester. John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft.

0 Comments

|

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed