The Saturday Economist ... Monthly Round Up of Key US Economics Data

|

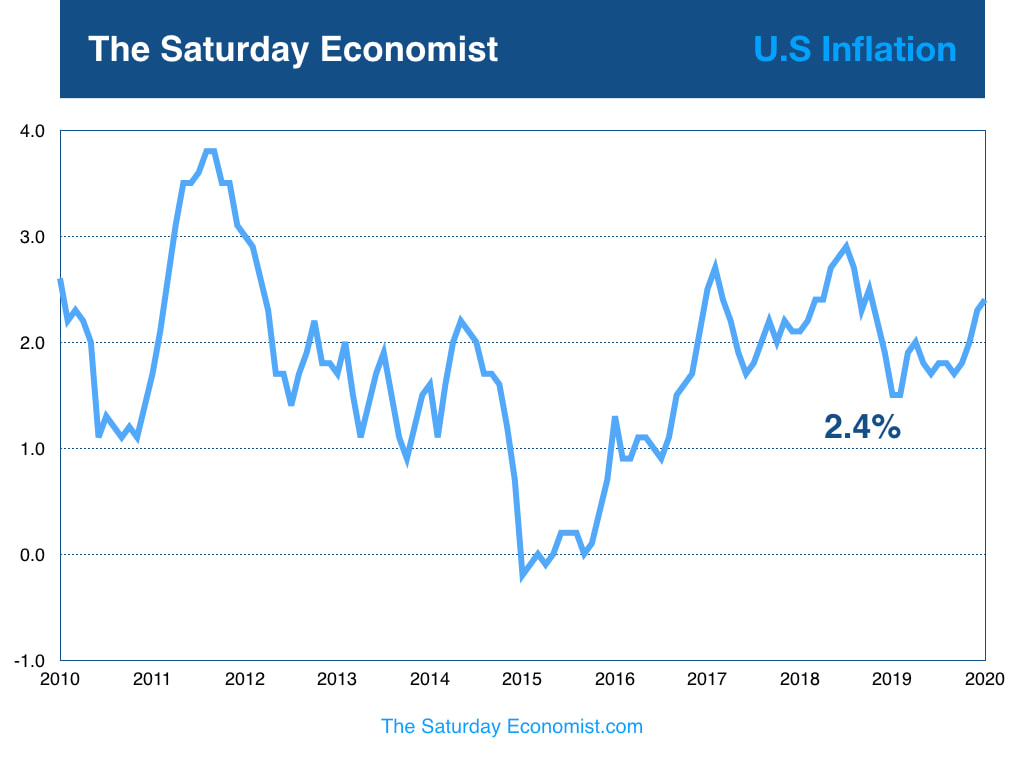

U.S Inflation

US inflation was 2.0% in the latest data for October. We expect inflation for the year as a whole to be 1.9% in 2019 rising to 2.0% in 2020. U.S Unemployment

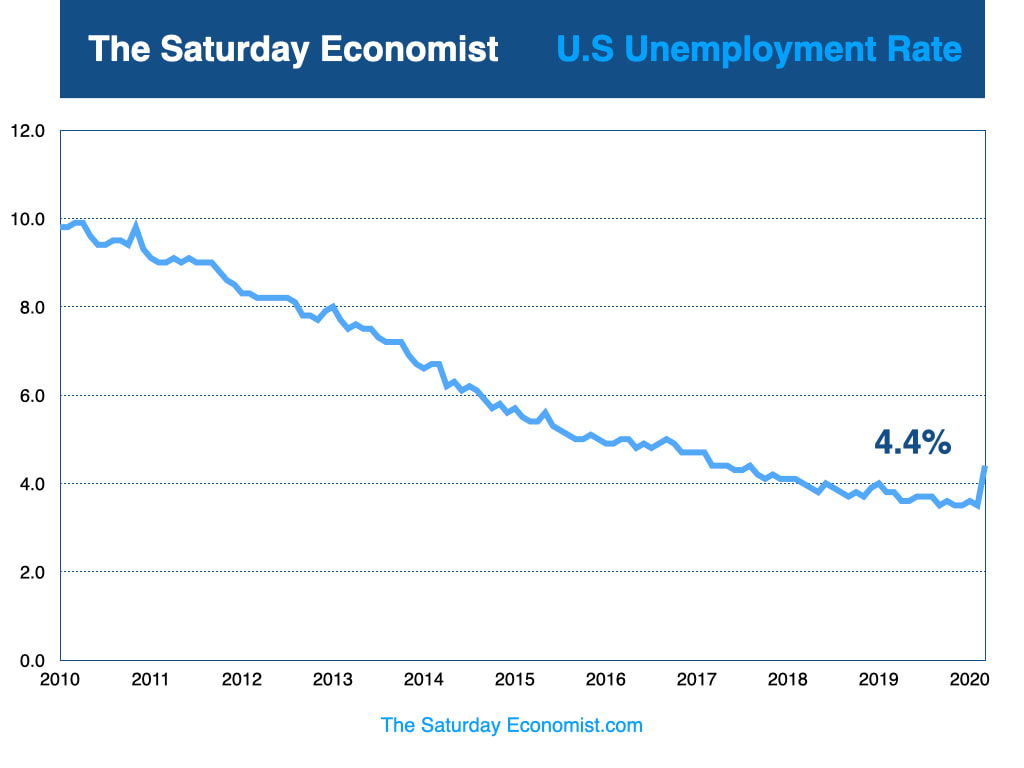

The unemployment rate was 3.5% in the latest data for October. We expect the current levels to hold towards the end of the year and in to 2020. U.S Inflation

US inflation was 2.0% in the latest data for October. We expect inflation for the year as a whole to be 1.9% in 2019 rising to 2.0% in 2020. U.S Business Confidence

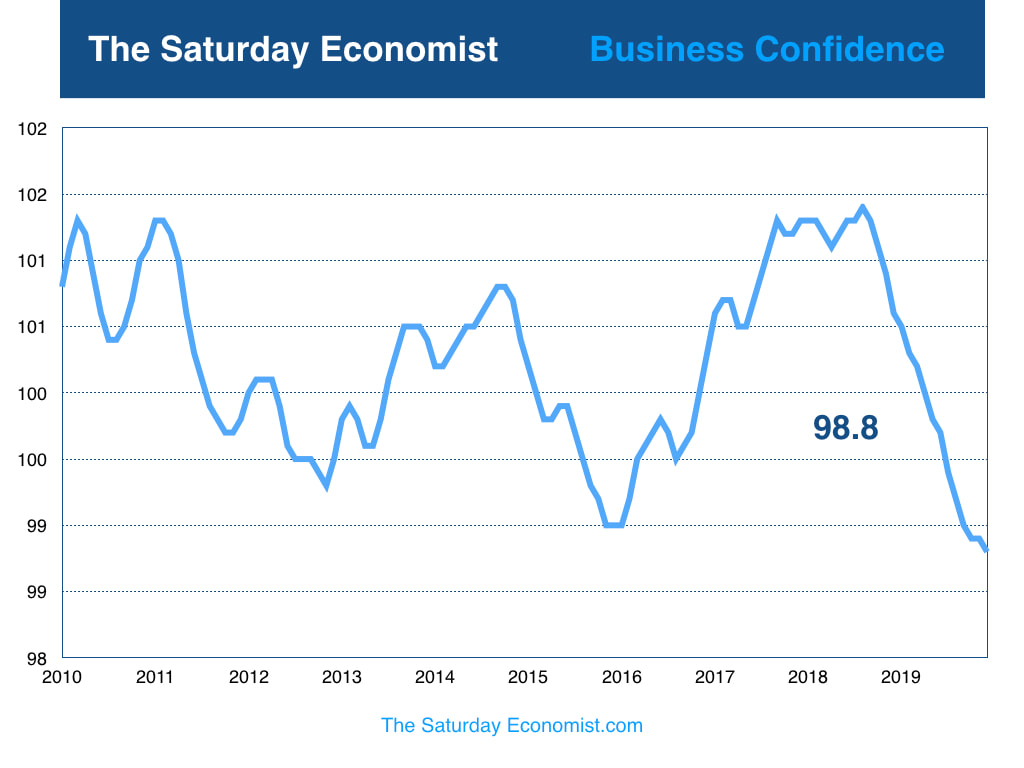

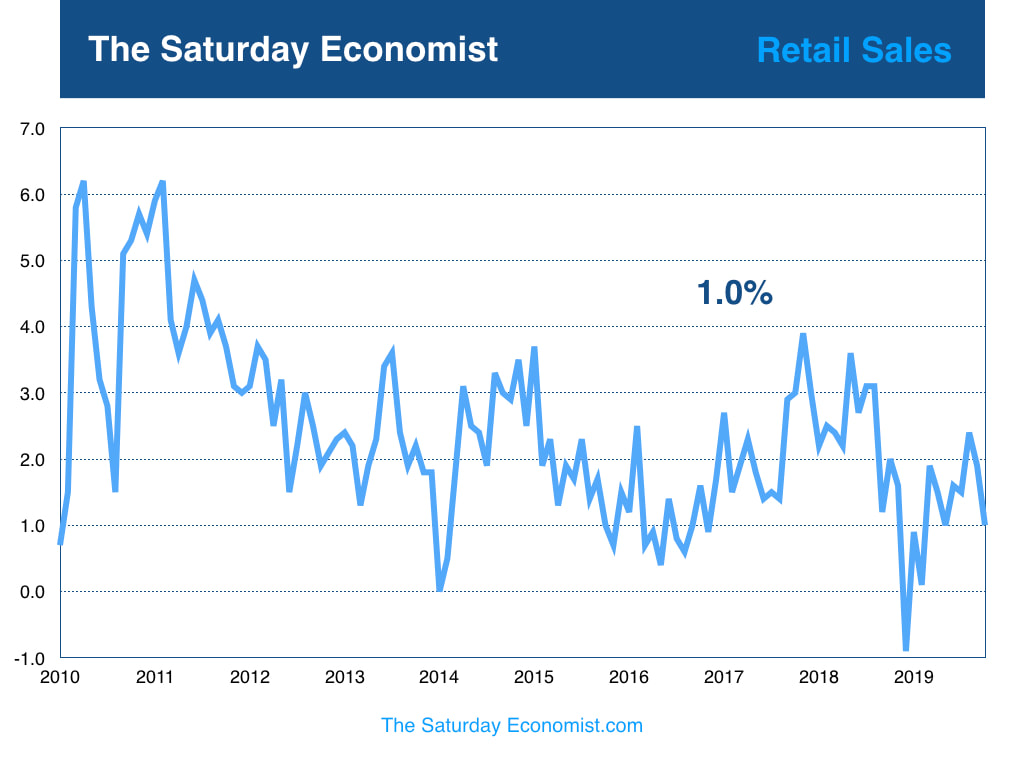

Business confidence fell to the lowest levels since 2016 as concerns rise about trade tariffs and a slow down in the US economy generally. Impeachment concerns will augment doubts about direction ... U.S Retail Sales Volumes

Retail sales volumes year on year have increased from the slow down at the start of the year to 2.1% in the latest data for October. We expect volume to increase in 2020 by just over 2% ... |

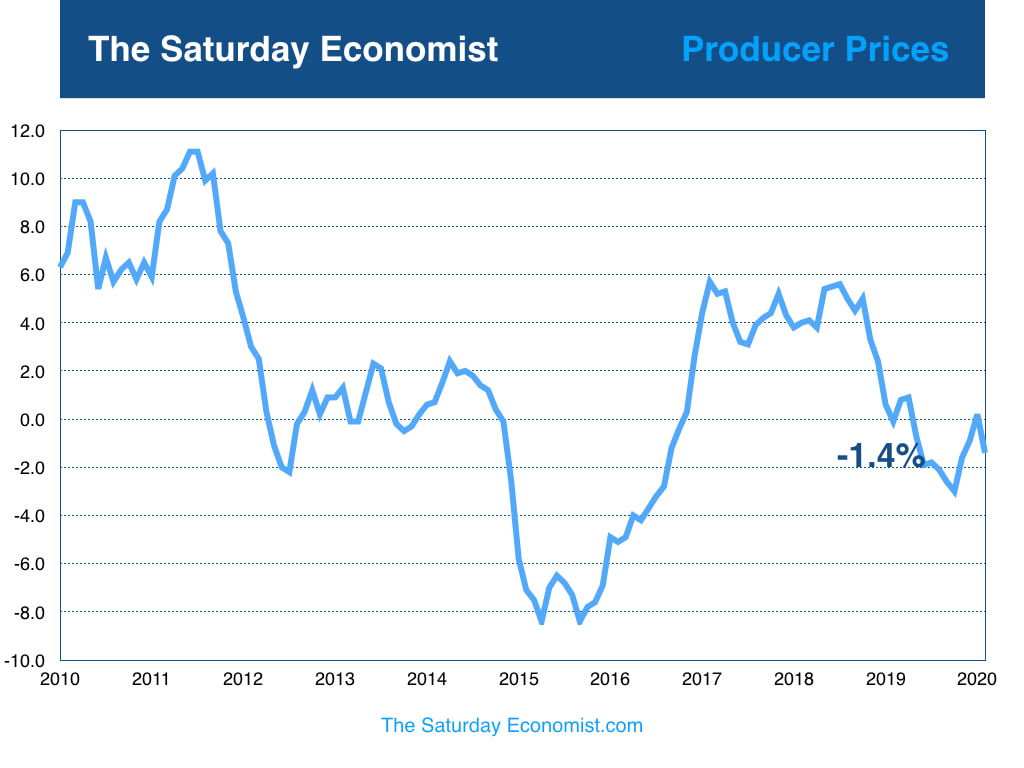

U.S Producer Prices

Producer Prices fell by 1.9% in the latest data for October. We expect further weakness towards the end of the year before leveling out in 2020. U.S Earnings

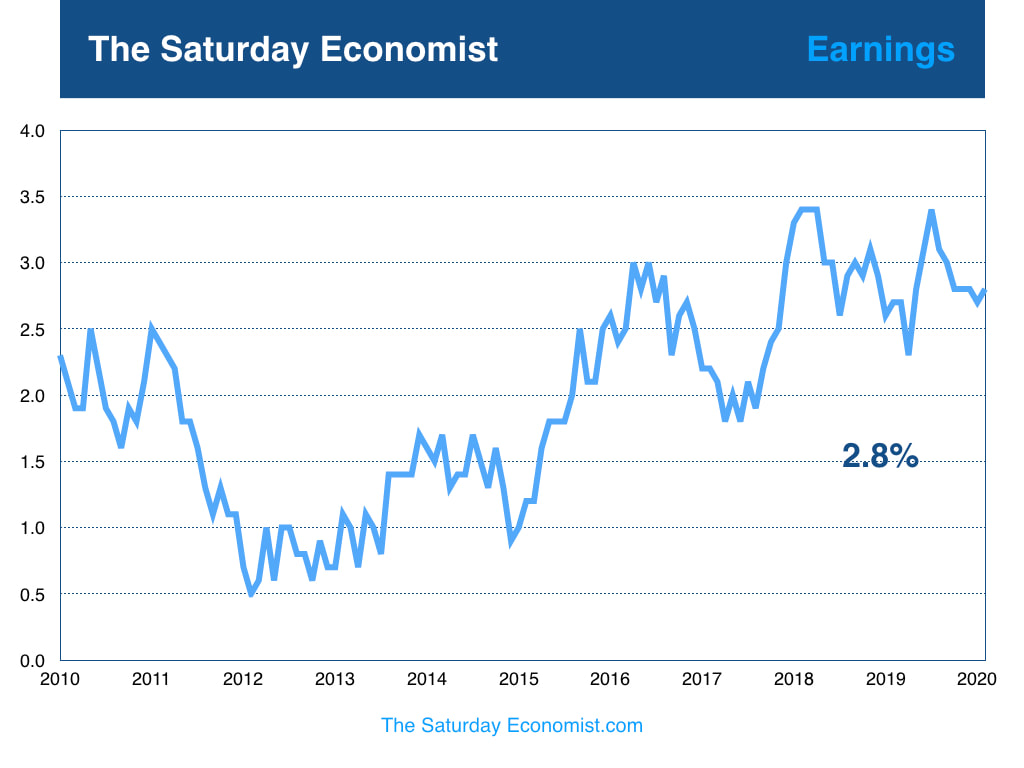

Latest earnings data suggests wages are rising by 2.7% in the US. We expect a further increase to 2.9% by the end of the year rising to 3.0% in 2020. U.S. Manufacturing Output

US manufacturing output fell by 1.3% in October as the economy slows. For the year as a whole we expect a fall of around 1.5% before rallying to 1.5% growth in 2020. U.S Consumer Confidence

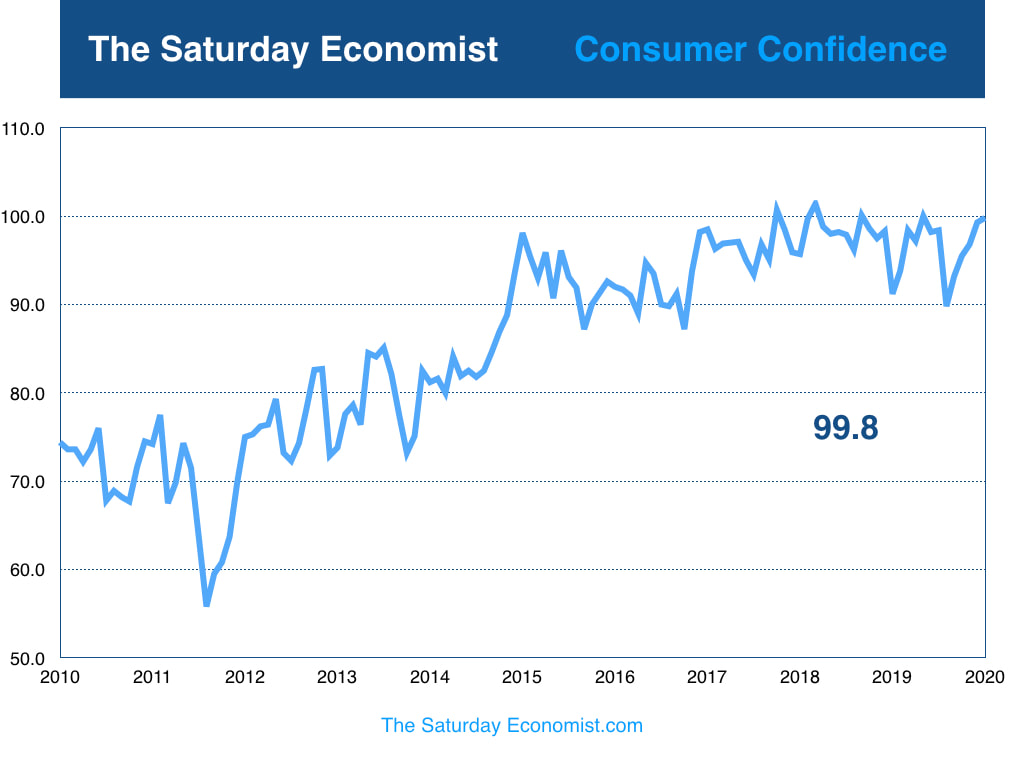

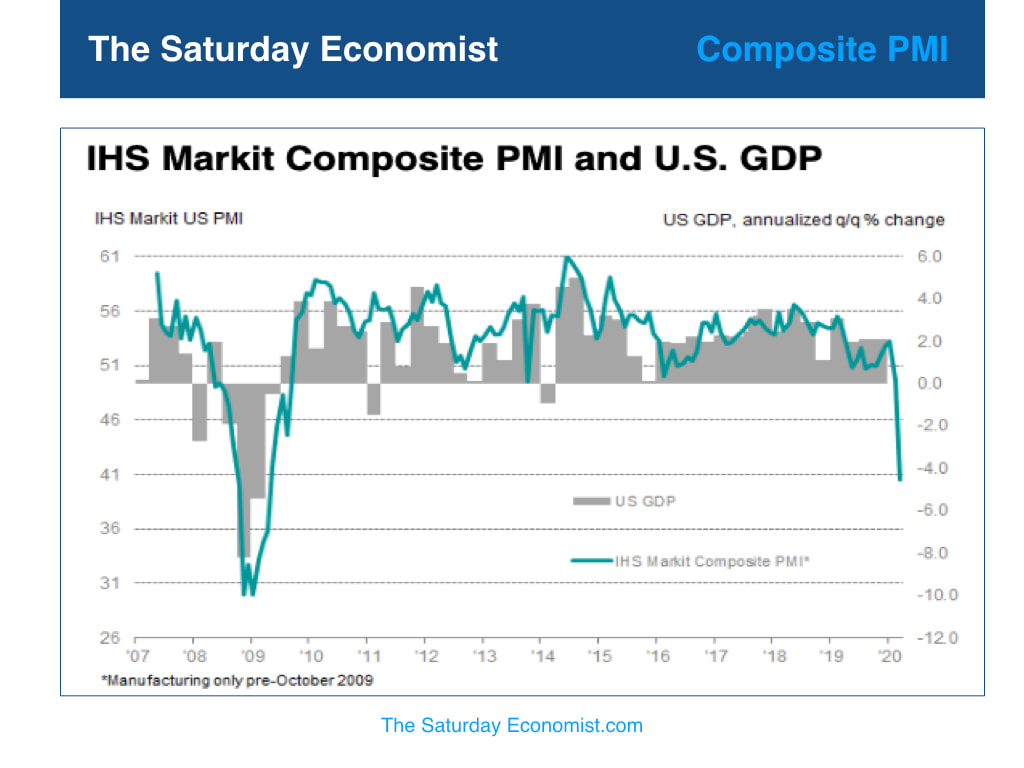

From a low of 90 in August, consumer confidence has rallied slightly as employment increases and the unemployment rate holds steady at 3.5%. The rise in real incomes will assist sentiment. U.S Composite PMI

The IHS Markit Flash U.S. Output Index posted 52.2 in December, up from 52.0 in November. We expect U.S. growth this year of 2.3% slowing from 2.9% last year. Our 2020 expectation is growth of 2.1%. |

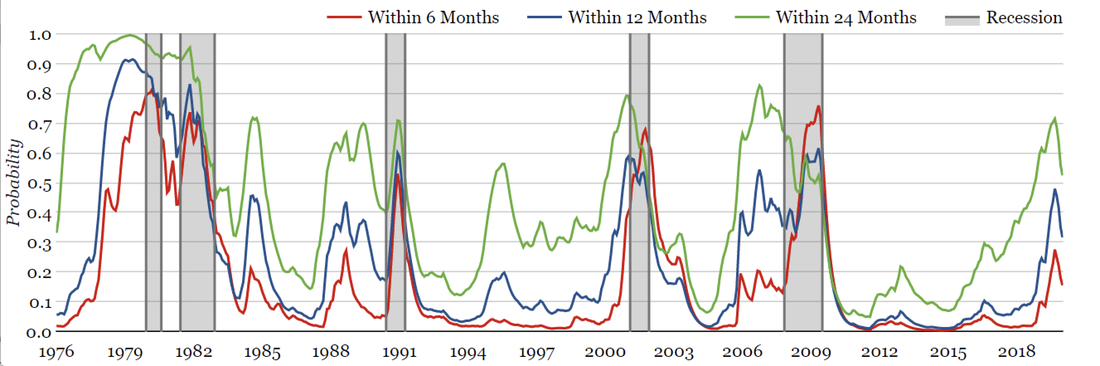

U.S. Recession Forecasting Model ... developed by Terrence Zhang of Wells Fargo ...

January Update ...

Model recession probabilities continue diving downwards across all time frames.

Current Predictions (as of January 7, 2020)

Within 6 months: 15.5%

Within 12 months: 31.6%

Within 24 months: 52.4%

Model recession probabilities continue diving downwards across all time frames.

Current Predictions (as of January 7, 2020)

Within 6 months: 15.5%

Within 12 months: 31.6%

Within 24 months: 52.4%