The Great Devaluation Myth ...

Nine reasons why devaluation doesn’t improve the UK balance of payments …

So what did you do your PhD in then ...

When people ask me "So what did you do your PhD in" ... I normally say, "Jeans and a T Shirt". It's much simpler than the reality. The title of my PhD was "Determinants of the Cyclically Adjusted UK Trade in Goods Deficit 1980 - 1992." Five long years of research into international trade and the prospects for the UK economy.

Modelling UK Trade ...

We model exports as a function of relative price and demand using world trade as a proxy. We model imports as a function of domestic demand or total final expenditure and relative import prices. In both cases the demand parameters are dominant, price elasticities are less significant with regard to exports and with regard to imports relatively inelastic. There is no substitution effect.

When people ask me "So what did you do your PhD in" ... I normally say, "Jeans and a T Shirt". It's much simpler than the reality. The title of my PhD was "Determinants of the Cyclically Adjusted UK Trade in Goods Deficit 1980 - 1992." Five long years of research into international trade and the prospects for the UK economy.

Modelling UK Trade ...

We model exports as a function of relative price and demand using world trade as a proxy. We model imports as a function of domestic demand or total final expenditure and relative import prices. In both cases the demand parameters are dominant, price elasticities are less significant with regard to exports and with regard to imports relatively inelastic. There is no substitution effect.

If devaluation solved the problems of the British Economy, the UK would have one of the strongest trade balances in the world

The depreciation of sterling in 2008 did not lead to a significant improvement in the balance of payments. The depreciation of 2016 did not do so either. In 2008, there was no "re balancing effect". In 2016, there was no "re balancing effect". We always argued this would be the case. History and empirical observation provides the evidence.

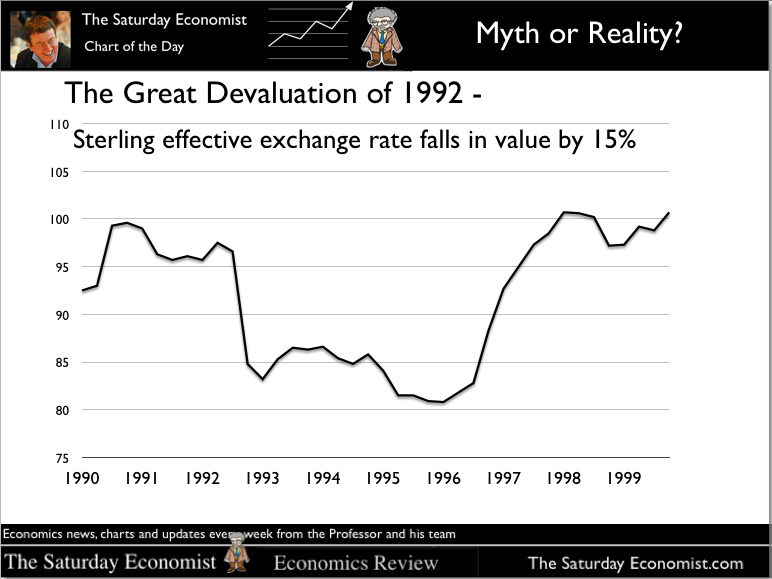

In 1992, there was no improvement in trade as a result of the exit from the ERM and the subsequent devaluation, despite allusions of policy makers to the contrary. Check out our chart of the day and the more extensive slide deck below.

The depreciation of sterling in 2008 did not lead to a significant improvement in the balance of payments. The depreciation of 2016 did not do so either. In 2008, there was no "re balancing effect". In 2016, there was no "re balancing effect". We always argued this would be the case. History and empirical observation provides the evidence.

In 1992, there was no improvement in trade as a result of the exit from the ERM and the subsequent devaluation, despite allusions of policy makers to the contrary. Check out our chart of the day and the more extensive slide deck below.

Nine reasons why devaluation doesn’t improve the UK balance of payments …

1 Exporters Price to Market …

and price in currency … there is limited pass through effect for major exporters as a result of currency moves …

2 Portfolio Management ...

Exporters and importers adopt a balanced portfolio approach via synthetic or natural hedging to offset the currency risks over the long term …

3 Medium Term View ...

Traders adopt a strategic medium term view on currency trends, better to take the margin boost or hit in the short term …. rather than price out the currency move only to be forced into a readjustment just months later ...

4 High Import : Export Correlation ...

Imports form a significant part of exports, either as raw materials, components or semi manufactures. Devaluation increases the costs of exports as a result of devaluation ... exporters risk a margin squeeze as revenue falls and costs increase ...

5 Limited Import Substitution Effect ...

There is limited import substitution effect or potential domestic supply side boost ... because of limits to capacity and inhibitions to investment ...

6 The Export : Import Model ...

We model exports as a function of demand (world trade) and price [X (f) W, P]; We imports as a function of growth and price where M (f) Y,P.

7 Demand Coefficients are dominant ...

Demand coefficients are dominant in the import - export model ... price coefficients are less dominant.

8 Price elasticities for imports are lower than for exports …

Price elasticities for imports are lower than for exports … partly because of the limited substitution effect/

The Marshall Lerner conditions are not satisfied … The price elasticities are too limited to offset the "lost revenue" impact ...

9 Commodities have limited price elasticity ...

Imports of food, beverages, commodities, energy, oil and semi manufactures are relatively inelastic with regard to price. The price coefficients are much weaker and almost inelastic with regard to imported goods ... there can be no substitution effect.

1 Exporters Price to Market …

and price in currency … there is limited pass through effect for major exporters as a result of currency moves …

2 Portfolio Management ...

Exporters and importers adopt a balanced portfolio approach via synthetic or natural hedging to offset the currency risks over the long term …

3 Medium Term View ...

Traders adopt a strategic medium term view on currency trends, better to take the margin boost or hit in the short term …. rather than price out the currency move only to be forced into a readjustment just months later ...

4 High Import : Export Correlation ...

Imports form a significant part of exports, either as raw materials, components or semi manufactures. Devaluation increases the costs of exports as a result of devaluation ... exporters risk a margin squeeze as revenue falls and costs increase ...

5 Limited Import Substitution Effect ...

There is limited import substitution effect or potential domestic supply side boost ... because of limits to capacity and inhibitions to investment ...

6 The Export : Import Model ...

We model exports as a function of demand (world trade) and price [X (f) W, P]; We imports as a function of growth and price where M (f) Y,P.

7 Demand Coefficients are dominant ...

Demand coefficients are dominant in the import - export model ... price coefficients are less dominant.

8 Price elasticities for imports are lower than for exports …

Price elasticities for imports are lower than for exports … partly because of the limited substitution effect/

The Marshall Lerner conditions are not satisfied … The price elasticities are too limited to offset the "lost revenue" impact ...

9 Commodities have limited price elasticity ...

Imports of food, beverages, commodities, energy, oil and semi manufactures are relatively inelastic with regard to price. The price coefficients are much weaker and almost inelastic with regard to imported goods ... there can be no substitution effect.

Curiouser and Curiouser - the myth of devaluation continues. The 1992 experience ....

"The UK’s trade performance since the onset of the economic downturn in 2008 has been one of the more curious developments in the UK economy” according to a report from the Office for National Statistics. "Explanation beyond exchange rates: trends in UK trade since 2007. We would argue, it is only curious for those who choose to ignore history.

Much reference is made to the period 1990 - 1995 when the last “great depreciation led to an improvement in the balance of payments" - allegedly. Analysing the trade in goods data [BOKI] from the ONS own report demonstrates the failure of depreciation to improve the net trade in goods performance in the period 1990 - 1995.

Despite the fall in sterling, the inexorable structural decline in net trade in goods continued throughout. Demand co-efficients are powerful, the price co-efficients much weaker and almost inelastic with regard to imports. Check out the slide show below for more information.

The conclusions from the ONS report do not add up. Curiouser and Curiouser, policy makers just like Alice, sometimes choose to believe in as many as six impossible things before breakfast. That "devaluation will improve the trade balance is one of them".

"The UK’s trade performance since the onset of the economic downturn in 2008 has been one of the more curious developments in the UK economy” according to a report from the Office for National Statistics. "Explanation beyond exchange rates: trends in UK trade since 2007. We would argue, it is only curious for those who choose to ignore history.

Much reference is made to the period 1990 - 1995 when the last “great depreciation led to an improvement in the balance of payments" - allegedly. Analysing the trade in goods data [BOKI] from the ONS own report demonstrates the failure of depreciation to improve the net trade in goods performance in the period 1990 - 1995.

Despite the fall in sterling, the inexorable structural decline in net trade in goods continued throughout. Demand co-efficients are powerful, the price co-efficients much weaker and almost inelastic with regard to imports. Check out the slide show below for more information.

The conclusions from the ONS report do not add up. Curiouser and Curiouser, policy makers just like Alice, sometimes choose to believe in as many as six impossible things before breakfast. That "devaluation will improve the trade balance is one of them".

A brief history of devaluation from 1925 onwards ....

The great devaluation of 1931 - 24%

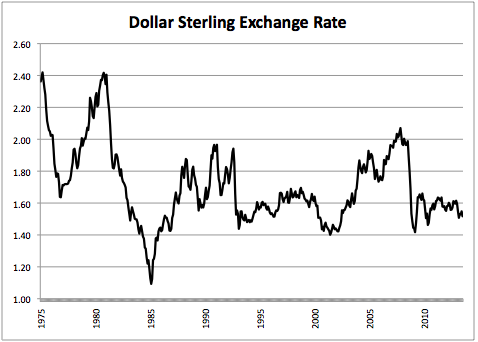

In 1925, the dollar sterling exchange rate was $4.87. Britain had readopted the gold standard. Unfortunately, the relative high value of the pound placed considerable pressure on the trade and capital account, the balance of payments problem developed into a "run on the pound". The UK left the gold standard in 1931, the floating pound quickly dropped to $3.69, providing an effective devaluation of 24%. The gain, if such it was, could not be sustained. Over the next two years, confidence in the currency returned, the dollar weakened, sterling rallied in value to a level of $5.00 but ...

Fears of conflict in Europe placed pressure on the sterling. In 1939, with the outbreak of World War II the rate dropped to $3.99 from $4.61. In March, 1940, the British government pegged the value of the pound to the dollar, at $4.03.

The great devaluation of 1949 - 30%

Post war, Britain was heavily indebted to the USA. Despite a soft loan agreement with repayments over fifty years, the pound remained once again under intense pressure In 1949 Stafford Cripps devalued the pound by over 30%, giving a rate of $2.80

The great devaluation of 1967 - 14%

In 1967 another "balance of payments" crisis developed in the British economy with a subsequent "run on the pound. Harold Wilson announced, in November 1967, the pound had been devalued by just over 14%, The dollar sterling exchange rate fell to $2.40. This the famous "pound in your pocket" devaluation. Wilson tried to reassure the country by pointing out that the devaluation would not affect the value of money within Britain.

In 1971, currencies began to float, depreciation not devaluation became the guideline

In 1925, the dollar sterling exchange rate was $4.87. Britain had readopted the gold standard. Unfortunately, the relative high value of the pound placed considerable pressure on the trade and capital account, the balance of payments problem developed into a "run on the pound". The UK left the gold standard in 1931, the floating pound quickly dropped to $3.69, providing an effective devaluation of 24%. The gain, if such it was, could not be sustained. Over the next two years, confidence in the currency returned, the dollar weakened, sterling rallied in value to a level of $5.00 but ...

Fears of conflict in Europe placed pressure on the sterling. In 1939, with the outbreak of World War II the rate dropped to $3.99 from $4.61. In March, 1940, the British government pegged the value of the pound to the dollar, at $4.03.

The great devaluation of 1949 - 30%

Post war, Britain was heavily indebted to the USA. Despite a soft loan agreement with repayments over fifty years, the pound remained once again under intense pressure In 1949 Stafford Cripps devalued the pound by over 30%, giving a rate of $2.80

The great devaluation of 1967 - 14%

In 1967 another "balance of payments" crisis developed in the British economy with a subsequent "run on the pound. Harold Wilson announced, in November 1967, the pound had been devalued by just over 14%, The dollar sterling exchange rate fell to $2.40. This the famous "pound in your pocket" devaluation. Wilson tried to reassure the country by pointing out that the devaluation would not affect the value of money within Britain.

In 1971, currencies began to float, depreciation not devaluation became the guideline

|

In 1977, sterling fell against the dollar with pound plummeting to a low of $1.63 in the autumn 1976. Another sterling crisis and a run on the pound. The British government was forced to borrow from the IMF to bridge the capital gap. The princely sum of £2.3 billion was required to restore confidence in the pound.

By 1981, the pound was trading back at the $2.40 level but not for long. Parity was the pursuit by 1985 as the pound fell in value to a month low of $1.09 in February 1985. In the late 1980s, Chancellor Lawson was pegging the pound to the Deutsche Mark to establish some form of stability for the currency. In October of 1990, Chancellor Major persuaded Cabinet to enter the ERM, the European Exchange Rate Mechanism. The DM rate was 2.95 to the pound and $1.9454 against the dollar. Less than two years later, Britain left the European experiment. The strains of holding the currency within the trading band had pushed interest rates to 12% in September, with some suggestions that rates would have to rise to 20% to maintain the peg. In September 1992, Chancellor Lamont announced the withdrawal from the ERM. The Pound fell in value against the dollar from $1.94 to $1.43, an effective depreciation of 26%. According to the wider Bank of England Exchange rate the weighted depreciation was 15%. |

The devaluation of Sterling in 1992 had little impact on the trade balance ....

For further publications on Sterling and the Balance of Payments check out the discussion papers on the subject.

The Saturday Economist Discussion Papers 2012

Depreciation of Sterling 2008 - 2011 April 2012

Forty Years of UK Trade 1970 – 2010 April 2012

UK recoveries Compared 1930 – 2012 May 2012

Don’t worry about the Euro, it has little impact on trade with Europe May 2012

Blog Posts Just click on the articles to see the archive material ...

UK Trade deficit : Jabberwocks, Jormungands and J Curves – but no march of the makers July 2011

Puzzles at the Bank of England as the Economy does not fit the models April 2011

UK trade deficit, this is no time to be bashing the banks April 2011

Pickles, the run on the Pound and the Sterling crisis 1931 April 2011 lost in the archives

The Pound in your pocket - lessons from history 1967 March 2011 lost in the archives

UK Trade - the J curve is down the U bend February 2011 lost in the archives

Explaining UK export growth and the mythical impact of devaluation June 2010 lost in the archives

UK Balance of Payments Crisis 1931, deficits with inky blots and rotten bonds sustained. July 2009 lost in the archives

UK Motor trade and the Balance of Payments - Sterling does not figure February 2009 lost in the archives

UK Trade Deficit January £77 billion- why sterling does not impact March 2009 lost in the archives

UK Trade deficit widens - six reasons why sterling does not impact January 2009 lost in the archives

Major Works on this subject

Sterling in Decline, The devaluations of 1931, 1949 and 1967. Sir Alec Cairncross, Professor Barry Eichengreen 1983, 2003.

Britain and the Sterling Area: From Devaluation to Convertibility in the 1950s Dr Catherine Schenk 1994

The Decline of Sterling: Managing the Retreat of an International Currency, 1945-1992 Catherine R. Schenk 2010

Balance of Payments Theory and the UK Experience A P Thirlwall Macmillan Press 1980 Thirlwall Gibson 1992

The Saturday Economist Discussion Papers 2012

Depreciation of Sterling 2008 - 2011 April 2012

Forty Years of UK Trade 1970 – 2010 April 2012

UK recoveries Compared 1930 – 2012 May 2012

Don’t worry about the Euro, it has little impact on trade with Europe May 2012

Blog Posts Just click on the articles to see the archive material ...

UK Trade deficit : Jabberwocks, Jormungands and J Curves – but no march of the makers July 2011

Puzzles at the Bank of England as the Economy does not fit the models April 2011

UK trade deficit, this is no time to be bashing the banks April 2011

Pickles, the run on the Pound and the Sterling crisis 1931 April 2011 lost in the archives

The Pound in your pocket - lessons from history 1967 March 2011 lost in the archives

UK Trade - the J curve is down the U bend February 2011 lost in the archives

Explaining UK export growth and the mythical impact of devaluation June 2010 lost in the archives

UK Balance of Payments Crisis 1931, deficits with inky blots and rotten bonds sustained. July 2009 lost in the archives

UK Motor trade and the Balance of Payments - Sterling does not figure February 2009 lost in the archives

UK Trade Deficit January £77 billion- why sterling does not impact March 2009 lost in the archives

UK Trade deficit widens - six reasons why sterling does not impact January 2009 lost in the archives

Major Works on this subject

Sterling in Decline, The devaluations of 1931, 1949 and 1967. Sir Alec Cairncross, Professor Barry Eichengreen 1983, 2003.

Britain and the Sterling Area: From Devaluation to Convertibility in the 1950s Dr Catherine Schenk 1994

The Decline of Sterling: Managing the Retreat of an International Currency, 1945-1992 Catherine R. Schenk 2010

Balance of Payments Theory and the UK Experience A P Thirlwall Macmillan Press 1980 Thirlwall Gibson 1992