Friday Forward Guidance ...

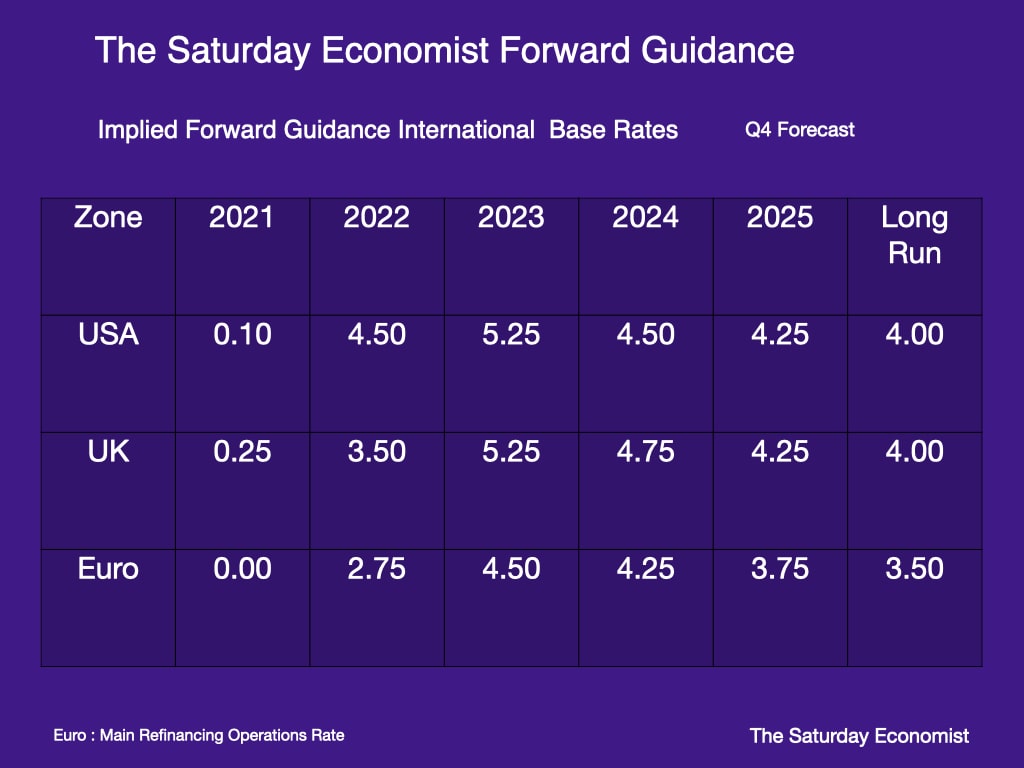

This is our Friday Forward Guidance for Friday 19th April. Every week we update our scenario forecasts for base rates in the U.S., UK and Europe over a three year period. We also include our expectations for inflation, as an input to the central bank reaction function, in the Saturday Economist updates.

In latest central bank moves, the Bank of England’s Monetary Policy Committee (MPC) voted 8 to 1 in favour of maintaining the base rate at 5.25% for the fifth consecutive month. Governor Bailey confirmed inflation is moving in the right direction but the "Bank is not yet at the point, where interest rates can be cut".

The US central bank - the Federal Reserve opted to maintain its target range for the federal fund rate at 5.25% to 5.50%. “The committee wants to see more data that gives us higher confidence that inflation is moving down sustainably toward 2%,” Chairman Powell said. “We don’t see this in the data right now.” Nevertheless markets expect three rate cuts this year.

Meanwhile, the Governing Council of the European Central Bank (ECB) held its three key interest rates at 4.00%, 4.50% and 4.75% in April. "The incoming information has broadly confirmed the Governing Council’s previous assessment of the medium-term inflation outlook. Inflation has continued to fall, led by lower food and goods price inflation. Most measures of underlying inflation are easing, wage growth is gradually moderating, and firms are absorbing part of the rise in labour costs in their profits. "

In latest central bank moves, the Bank of England’s Monetary Policy Committee (MPC) voted 8 to 1 in favour of maintaining the base rate at 5.25% for the fifth consecutive month. Governor Bailey confirmed inflation is moving in the right direction but the "Bank is not yet at the point, where interest rates can be cut".

The US central bank - the Federal Reserve opted to maintain its target range for the federal fund rate at 5.25% to 5.50%. “The committee wants to see more data that gives us higher confidence that inflation is moving down sustainably toward 2%,” Chairman Powell said. “We don’t see this in the data right now.” Nevertheless markets expect three rate cuts this year.

Meanwhile, the Governing Council of the European Central Bank (ECB) held its three key interest rates at 4.00%, 4.50% and 4.75% in April. "The incoming information has broadly confirmed the Governing Council’s previous assessment of the medium-term inflation outlook. Inflation has continued to fall, led by lower food and goods price inflation. Most measures of underlying inflation are easing, wage growth is gradually moderating, and firms are absorbing part of the rise in labour costs in their profits. "

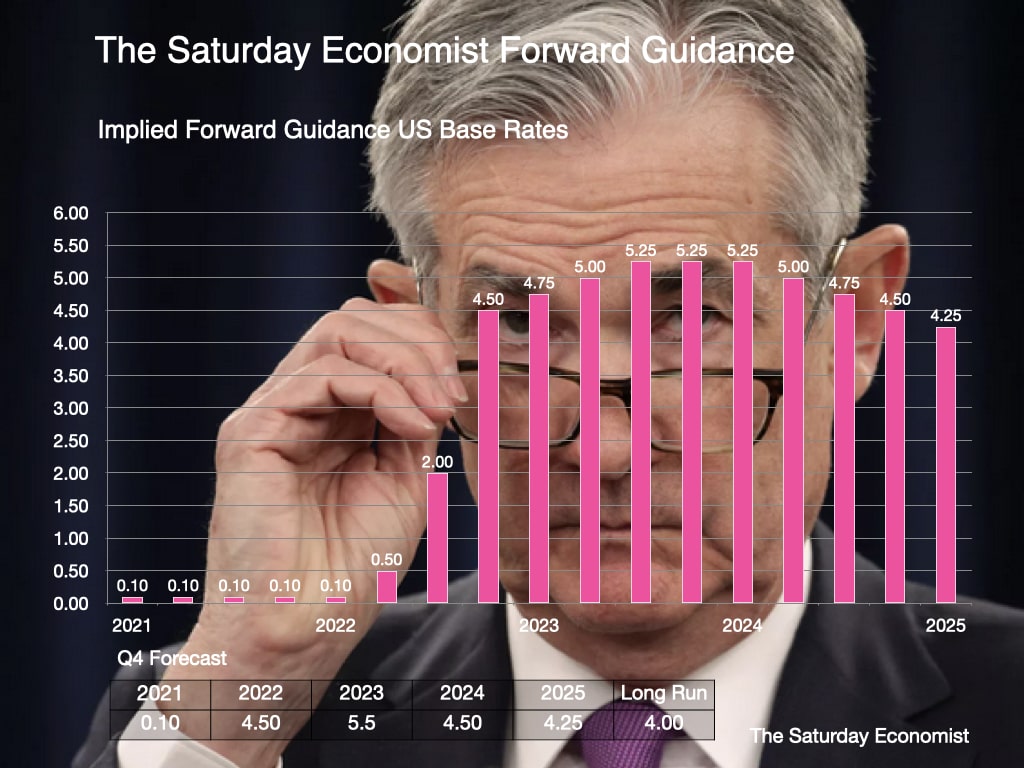

Fed Funds Rate ...

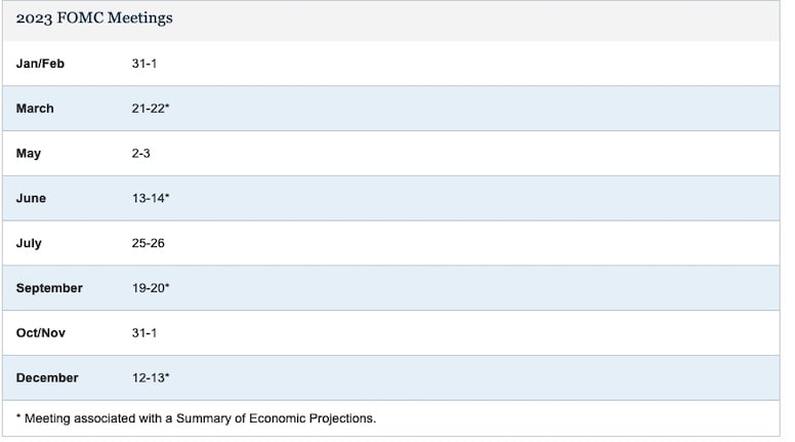

In the latest move, the March meeting, the Federal Reserve held interest rates unchanged. The target range for the Fed Funds Rate was maintained at 5.25% and 5.5%. The formal statement issued by the FOMC was cautious and guarded.

“The committee wants to see more data that gives us higher confidence that inflation is moving down sustainably toward 2%, we don’t see this in the data right now.”

Inflation CPI edged up to 3.5% in March from 3.2% in February. The underlying rate (excluding food and energy costs) was 3.8%. Producer price inflation moved up to 2.1% in March from 1.6% in February.

Growth in the U.S. accelerated to 3.1% in the fourth quarter. The US economy is in better shape than economists had expected. A strong labor market, sturdy consumer spending and now easing inflation have fueled hopes that the US will avoid a downturn.

The Fed March outlook, forecasts growth of 2.1% in 2024 and 2.0% in 2025 and 2026. We model growth at 2.5% in 2023, 2024, and 2025.

We continue to model U.S. base rates peaking at 5.25% in 2023 moving to 4.50% in late 2024. We expect the first cut in June.

The Fed Blue Dot forecasts suggest the Long Run average rate in the U.S is now 2.60%. Our model rate is around the 4.00% -4.50% level. Ten Year Bonds trade at just over 4.2% this morning,

In the latest move, the March meeting, the Federal Reserve held interest rates unchanged. The target range for the Fed Funds Rate was maintained at 5.25% and 5.5%. The formal statement issued by the FOMC was cautious and guarded.

“The committee wants to see more data that gives us higher confidence that inflation is moving down sustainably toward 2%, we don’t see this in the data right now.”

Inflation CPI edged up to 3.5% in March from 3.2% in February. The underlying rate (excluding food and energy costs) was 3.8%. Producer price inflation moved up to 2.1% in March from 1.6% in February.

Growth in the U.S. accelerated to 3.1% in the fourth quarter. The US economy is in better shape than economists had expected. A strong labor market, sturdy consumer spending and now easing inflation have fueled hopes that the US will avoid a downturn.

The Fed March outlook, forecasts growth of 2.1% in 2024 and 2.0% in 2025 and 2026. We model growth at 2.5% in 2023, 2024, and 2025.

We continue to model U.S. base rates peaking at 5.25% in 2023 moving to 4.50% in late 2024. We expect the first cut in June.

The Fed Blue Dot forecasts suggest the Long Run average rate in the U.S is now 2.60%. Our model rate is around the 4.00% -4.50% level. Ten Year Bonds trade at just over 4.2% this morning,

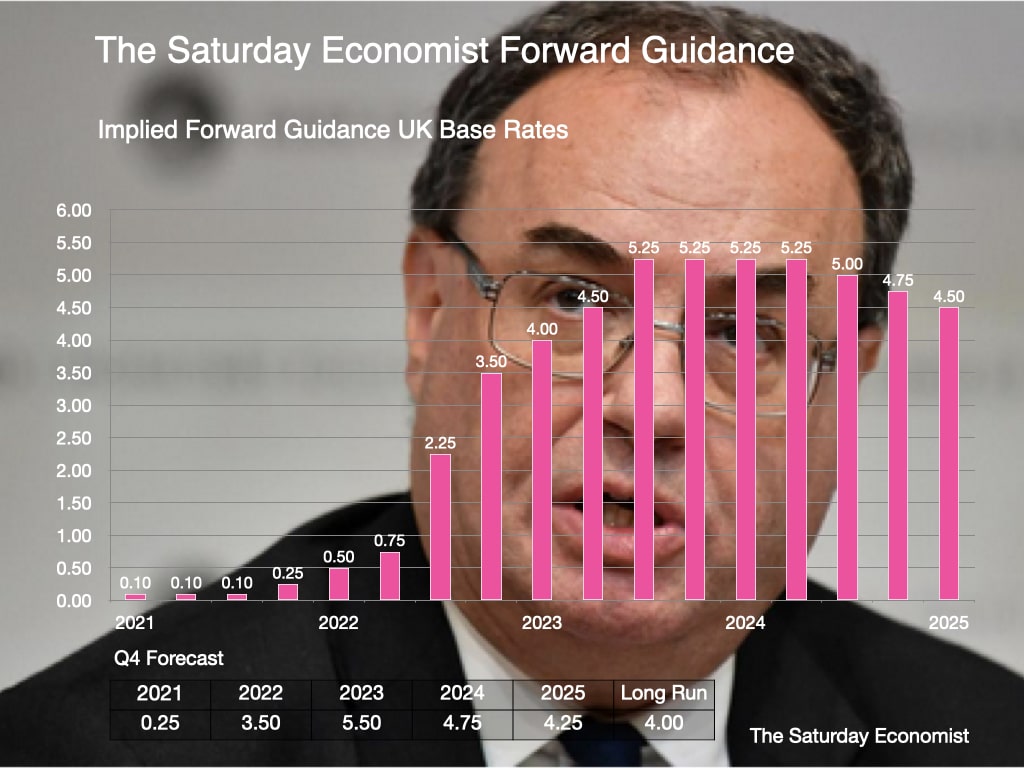

Bank Base Rate ...

At the latest MPC meeting in March, the committee voted by eight votes to one, to hold base rate at 5.25%. Swati Dhingra, alone, voted in favour of a 25 basis point reduction to the base rate.

Jonathan Haskel and Catherine Mann, voted to keep rates on hold. At the February meeting last month, they had voted for a 25 basis point increase. Markets assume the next move will be down. The first of a possible three cuts this year.

Inflation, CPI eased to 3.2% in March from 3.4% in February. Core inflation, moved to 4.2% from 4.5%. Food inflation eased to 3.9% from 5%. Energy costs were steady at -18.2%. Service sector inflation dropped to 6.0% from 6.1%. Goods inflation dropped to 0.8% from 1.1% .

CPI inflation is expected to fall to target 2.0% in the second quarter, according to forecasts from the OBR and The Bank of England. The Bank expects CPI inflation to average 2.8% in the final quarter. The OBR anticipates inflation to remain below target for the rest of the year, closing at 1.4% in the final quarter.

So what can we make of it all? Our overall forward guidance outlook remains unchanged. We expect a series of three base rate cuts in the current year possibly beginning, in June. We model base rates at 4.5% in the final quarter but not much more to follow in 2025.

* Long Term Note : In the UK, prior to the Great Financial Crash [2000 - 2008] the average inflation rate was 2.0%, the average UK bank rate was 4.50%. Ten year gilt yields averaged 4.50%, real GDP growth averaged 2.5%, earnings averaged 3.5%, the unemployment rate averaged 5%.

At the latest MPC meeting in March, the committee voted by eight votes to one, to hold base rate at 5.25%. Swati Dhingra, alone, voted in favour of a 25 basis point reduction to the base rate.

Jonathan Haskel and Catherine Mann, voted to keep rates on hold. At the February meeting last month, they had voted for a 25 basis point increase. Markets assume the next move will be down. The first of a possible three cuts this year.

Inflation, CPI eased to 3.2% in March from 3.4% in February. Core inflation, moved to 4.2% from 4.5%. Food inflation eased to 3.9% from 5%. Energy costs were steady at -18.2%. Service sector inflation dropped to 6.0% from 6.1%. Goods inflation dropped to 0.8% from 1.1% .

CPI inflation is expected to fall to target 2.0% in the second quarter, according to forecasts from the OBR and The Bank of England. The Bank expects CPI inflation to average 2.8% in the final quarter. The OBR anticipates inflation to remain below target for the rest of the year, closing at 1.4% in the final quarter.

So what can we make of it all? Our overall forward guidance outlook remains unchanged. We expect a series of three base rate cuts in the current year possibly beginning, in June. We model base rates at 4.5% in the final quarter but not much more to follow in 2025.

* Long Term Note : In the UK, prior to the Great Financial Crash [2000 - 2008] the average inflation rate was 2.0%, the average UK bank rate was 4.50%. Ten year gilt yields averaged 4.50%, real GDP growth averaged 2.5%, earnings averaged 3.5%, the unemployment rate averaged 5%.

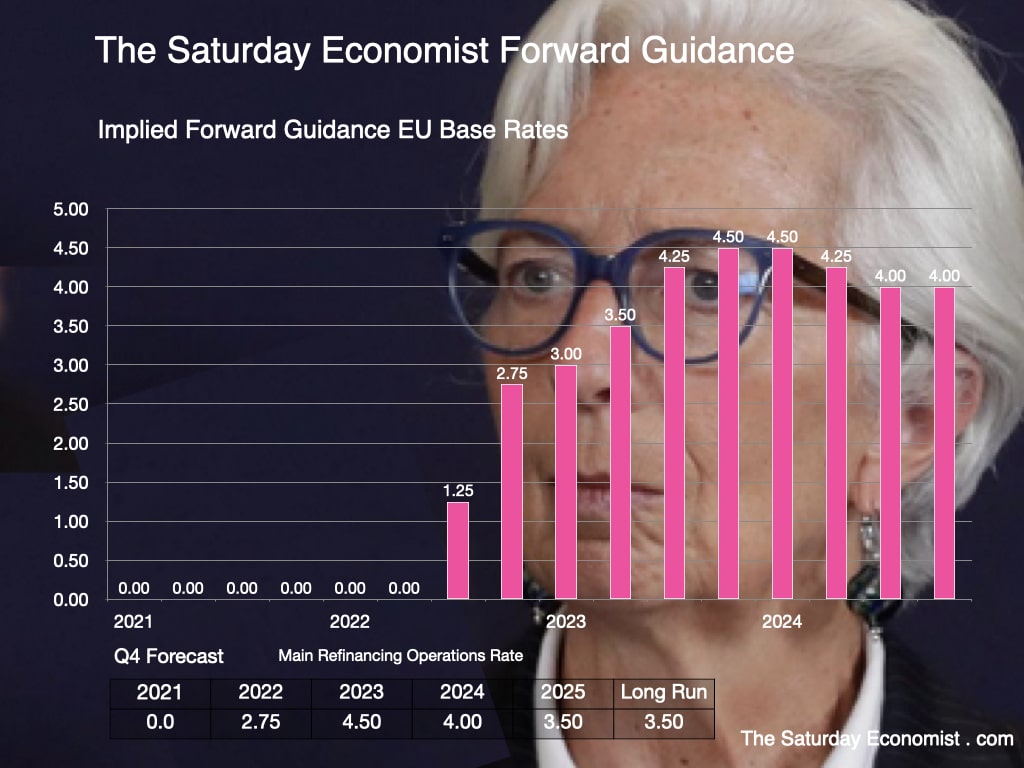

Euro Base Rate ...

Meanwhile, the Governing Council of the European Central Bank (ECB) held its three key interest rates at 4.00%, 4.50% and 4.75% in April. "The incoming information has broadly confirmed the Governing Council’s previous assessment of the medium-term inflation outlook.

Inflation has continued to fall, led by lower food and goods price inflation. Most measures of underlying inflation are easing, wage growth is gradually moderating, and firms are absorbing part of the rise in labour costs in their profits.

Financing conditions remain restrictive and the past interest rate increases continue to weigh on demand, which is helping to push down inflation. But domestic price pressures are strong and are keeping services price inflation high."

Previously, Lagarde had said " We expect rates (main refinancing operations) to peak at 4.50%. We expect the first rate cut by the end of the second quarter 2024.

Official figures showed that inflation in the Euro Area moved to 2.4 per cent in March from 2.6 per cent in February. Inflation in the European Union eased to 2.6% In March from 2.8% in February.

So what of rates? CNBC spoke to 12 members of the European Central Bank’s Governing Council, which votes on interest rate moves, in New York this week. There were two clear messages: expect a June cut, but beware of spillover effects from the Middle East.

We expect the first cut in June with a further two cuts possible before the end of the year, data dependent of course.

Meanwhile, the Governing Council of the European Central Bank (ECB) held its three key interest rates at 4.00%, 4.50% and 4.75% in April. "The incoming information has broadly confirmed the Governing Council’s previous assessment of the medium-term inflation outlook.

Inflation has continued to fall, led by lower food and goods price inflation. Most measures of underlying inflation are easing, wage growth is gradually moderating, and firms are absorbing part of the rise in labour costs in their profits.

Financing conditions remain restrictive and the past interest rate increases continue to weigh on demand, which is helping to push down inflation. But domestic price pressures are strong and are keeping services price inflation high."

Previously, Lagarde had said " We expect rates (main refinancing operations) to peak at 4.50%. We expect the first rate cut by the end of the second quarter 2024.

Official figures showed that inflation in the Euro Area moved to 2.4 per cent in March from 2.6 per cent in February. Inflation in the European Union eased to 2.6% In March from 2.8% in February.

So what of rates? CNBC spoke to 12 members of the European Central Bank’s Governing Council, which votes on interest rate moves, in New York this week. There were two clear messages: expect a June cut, but beware of spillover effects from the Middle East.

We expect the first cut in June with a further two cuts possible before the end of the year, data dependent of course.

Scenario Comparisons ...

This is the table of scenario comparisons. We would expect UK rates to lag not lead the US pattern. EU rates would follow the US/UK lead. Inflation may subside sooner than expected. Central banks may worry about the shock to growth. This is a scenario not the plan.

Our modified Taylor rule suggests the UK central bank is behind the curve on rate hikes. In our modified Taylor rule we model base rates as a function of inflation variance from target and the output gap relative to trend growth.

We model the long run rate at 4.0%. The Fed Blue dot projections assume 3.50% as the perceived long run rate. In the UK, prior to the Great Financial Crash [2000 - 2008] the average inflation rate was 2.0%, the average UK bank rate was 4.50%. Ten year bond yields averaged 4.50%.

This is the table of scenario comparisons. We would expect UK rates to lag not lead the US pattern. EU rates would follow the US/UK lead. Inflation may subside sooner than expected. Central banks may worry about the shock to growth. This is a scenario not the plan.

Our modified Taylor rule suggests the UK central bank is behind the curve on rate hikes. In our modified Taylor rule we model base rates as a function of inflation variance from target and the output gap relative to trend growth.

We model the long run rate at 4.0%. The Fed Blue dot projections assume 3.50% as the perceived long run rate. In the UK, prior to the Great Financial Crash [2000 - 2008] the average inflation rate was 2.0%, the average UK bank rate was 4.50%. Ten year bond yields averaged 4.50%.

That's all for this week ... "to understand the markets you have to understand the economics" and we do ...

© 2024 John Ashcroft, Economics, Strategy and Financial Markets, experience worth sharing.

© 2024 John Ashcroft, Economics, Strategy and Financial Markets, experience worth sharing.